During its third-quarter earnings call, Harmonic’s CEO Patrick Harshman described having initiated a formal strategic review of its video business and has already received interest from potential buyers of the business. The video business, which represents about 40% of Harmonic’s total revenue, is seeing solid growth in its software-as-a-service (SaaS) segment, but declines in its traditional hardware business, which includes broadcast and contribution encoders, and other products designed to process and play out video.

While the video segment is growing more modestly, Harmonic’s broadband segment has grown considerably and is poised for even stronger growth in the next few years as major cable operators, including Charter Communications, begin their transition to Distributed Access Architectures (DAA) and FTTH. During the third quarter earnings call, Harmonic noted that its broadband products are now commercially deployed with 104 operators, which is up 21% year-over-year.

The potential sale of its video business at this point makes a lot of sense for Harmonic for a number of reasons. The primary reason would be to allow the company to shift 100% of its focus (and capital) on expanding the broadband segment and building on its market leadership position in the vCMTS and remote PHY product segments without having the drag of negative EBITDA coming from the video segment. Another major reason is that the video and broadband business segments aren’t driving the synergies the company was expecting when it figured that a shift in spending on broadband equipment would coincide with a shift in spending on video processing equipment. But here are some other reasons why a transaction makes sense:

- Traditional pay-TV providers are moving too slowly in embracing IP-based video delivery: Harmonic’s strength has always been in providing high-quality, hardware-based encoding and video processing platforms to traditional pay-TV providers, such as cable, telco, and satellite operators. As subscriber losses continue to mount, these operators have been less inclined to invest in their video infrastructure, but have also been less enthusiastic about migrating to lower-cost, cloud-based video delivery. They have been sweating their video assets in the hopes that margins would improve despite subscribers continuing to cancel. Unfortunately, rising content costs have eaten into any margins, creating an atmosphere of inertia among the world’s largest pay-TV providers. Commscope has felt the same impact on its video business, which was very heavily focused on service providers and broadcasters.

- Growth in video is in AVOD, FAST, and CDNs—areas where Harmonic has not had as much traction: Because Harmonic has historically been focused on the service provider and broadcast market segments, it has not gained traction in the segments that are seeing the fastest consumption growth right now. Specifically, the growth in AVOD (Advertising-based video on demand) and FAST (Free ad-supported streaming TV) channels and content is largely being processed through AWS, or other CDNs or platform providers like Broadpeak and ATEME. Harmonic’s SaaS offering is intended to address these markets, but it is crowded and distributed. To be successful in the long term, scale will be critical. And that scale will likely be achieved more quickly through the acquisition by a competitor or adjacent vendor.

- Despite the current inventory correction, the broadband segment is set to boom: There is no question that broadband operators are currently working through purchased inventory as they adjust to a demanding environment and a supply-chain environment that has changed. Subscriber growth at many cable operators has slowed and fiber buildouts by competitors have also slowed, reducing the need for some operators to make significant infrastructure upgrades in the short term. Nevertheless, the expectation is that the inventory digestion—at least for Harmonic’s customers—is ending this quarter. As a result, Harmonic has guided Q4 broadband revenue to be between $105M-$120M. In all likelihood, that will be its biggest quarter on record, with similar quarters set to follow as more operators ramp up their DAA efforts.

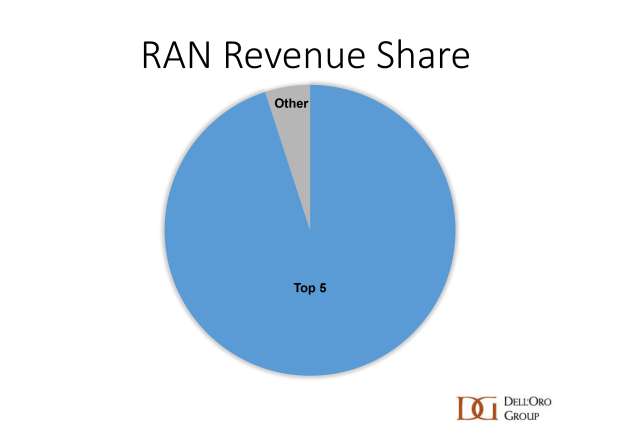

- Harmonic can potentially consolidate the cable broadband market: Timing is everything. Nowhere is that truer than in the broadband equipment space right now. The impact of inventory digestion and reduced demand has had an incredibly uneven impact on vendors. Nearly all have felt some pain. But the duration of that pain is forcing some equipment vendors to change their short-term strategies. We have already seen layoff announcements and other cost-cutting moves by some vendors who anticipate the spending slowdown to persist well into 2024. Others, like Commscope, are reportedly looking to sell off assets in order to ensure they can pay down debt and focus on their core product segments going forward. If, as reported, CommScope is looking to sell off its Access Networks Solution (ANS) unit, which it acquired when it purchased ARRIS back in 2019, Harmonic becomes a very interesting candidate to acquire the division, especially if Harmonic does sell off the video segment of the company. That additional capital might position Harmonic to take on less debt to acquire the significant cable footprint the former ARRIS would bring.

Beyond a global installed base of CCAP platforms, the ANS division would also give Harmonic a dominant position in the cable outside plant—specifically optical nodes, amplifiers, taps, and passives. A large percentage of these devices are going to be upgraded or replaced by Comcast, Charter, Cox, Rogers/Shaw, and others as they evolve from DOCSIS 3.1 to DOCSIS 4.0. In fact, we estimate that from 2023-2030, cable operators globally will spend a total of $9.9B on this outside plant equipment.

Currently, Harmonic does not focus on cable outside plant equipment. CommScope is estimated to be the global leader in cable outside plant equipment, particularly in the critical North American market. More importantly, CommScope is already working closely with Comcast on both 1.2GHz amplifiers as well as Full Duplex DOCSIS 4.0 amplifiers. Comcast remains Harmonic’s largest customer, representing 41% of Harmonic’s total revenue in the third quarter. For Comcast’s full duplex service to work as advertised, it will take close coordination of the vCMTS, nodes, Remote PHY Devices (RPDs), amplifiers, and CPE. With the current uncertainty around CommScope’s ANS division and where it might potentially land, Comcast undoubtedly has its preference and that is to an organization with whom its procurement department and network engineers are already familiar.

The arguments against Harmonic acquiring CommScope’s ANS division are many. Revenue is declining, as spending on traditional CCAP platforms is dropping faster than RPDs and amplifiers can offset. For many vendors, that declining CCAP market would be an absolute albatross. But if you are Harmonic and can convert a significant portion of that spend to cOS spend while also watching the RPD and amplifier spend increase then perhaps this all makes sense. Even if that legacy CCAP spend never returns because it is being replaced by fiber, Harmonic can recoup some of that revenue via cOS deployed as a vBNG or to simultaneously manage DOCSIS and fiber subscribers.

The existential question for Harmonic here is whether it wants to address the cable outside plant market. How many Comcasts are out there who are closely tying together their cable outside plant equipment purchases with their headend and control plane purchases? It certainly appears that this is happening at many more operators, as DOCSIS 4.0 roadmaps are closely intertwined like never before.