In our second blog on 5G Advanced, we outline the paths to 5G, and ultimately to 5G Advanced, regarding the 5G Core. We summarize the added functionality and refinements of the 5G Core in Releases 18 and 19 of the 3GPP standards. Finally, we review some of the implications and expected trends that 5G Advanced will enable. The heart of new monetization opportunities for Mobile Network Operators (MNOs) resides in the capability of the 5G Core to allow new use cases, some of which may still need to be imagined.

The Path to 5G Standalone (5G SA)

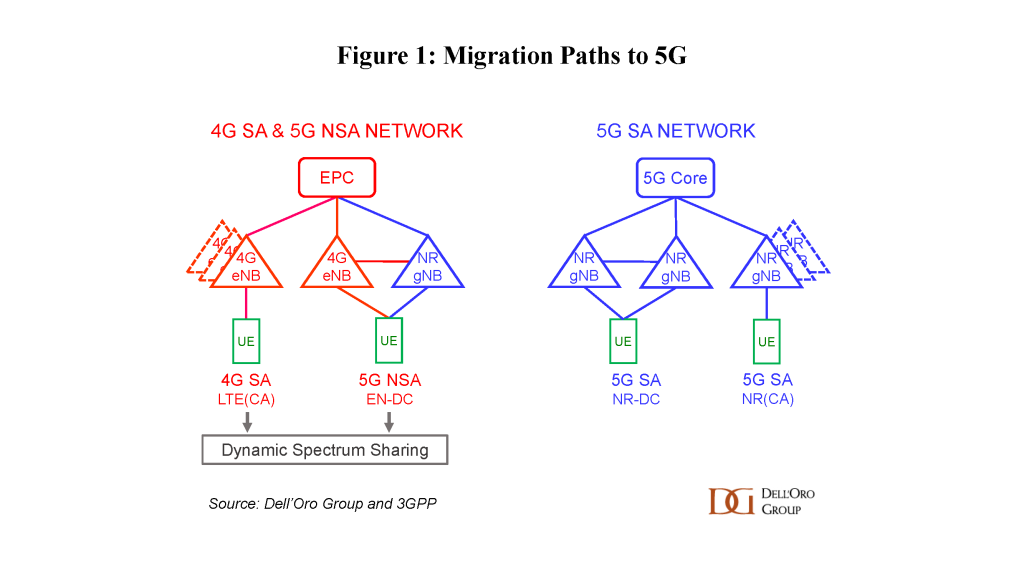

As shown in Figure 1, the path from 4G to 5G can take several routes—from the simplest to the most challenging implementation—including:

-

-

- Dynamic Spectrum Sharing (DSS)—allowing 5G to run on 4G radio access networks (RAN)

- 5G Non-Standalone (NSA)—allowing Dual Connectivity (DC) between 4G eNB radios and 5G New Radios (NR); NSA utilizes the 4G Evolved Packet Core (EPC)

- 5G Standalone (SA)—which utilizes only 5G components

The 5G SA network essential components include:

-

-

- 5G NRs in a single configuration with or without Carrier Aggregation (CA)

- 5G NRs in a DC configuration

- 5G Core

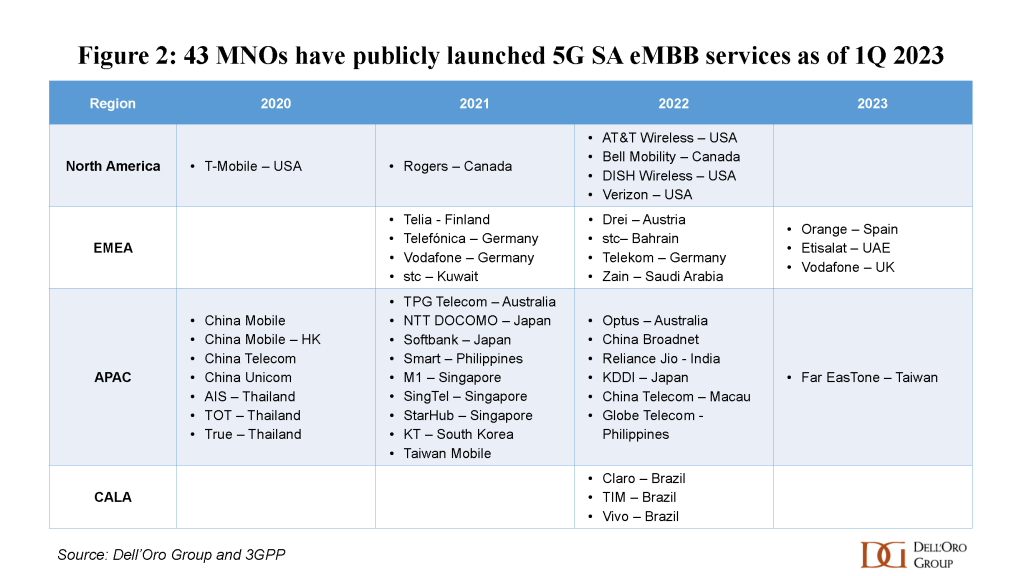

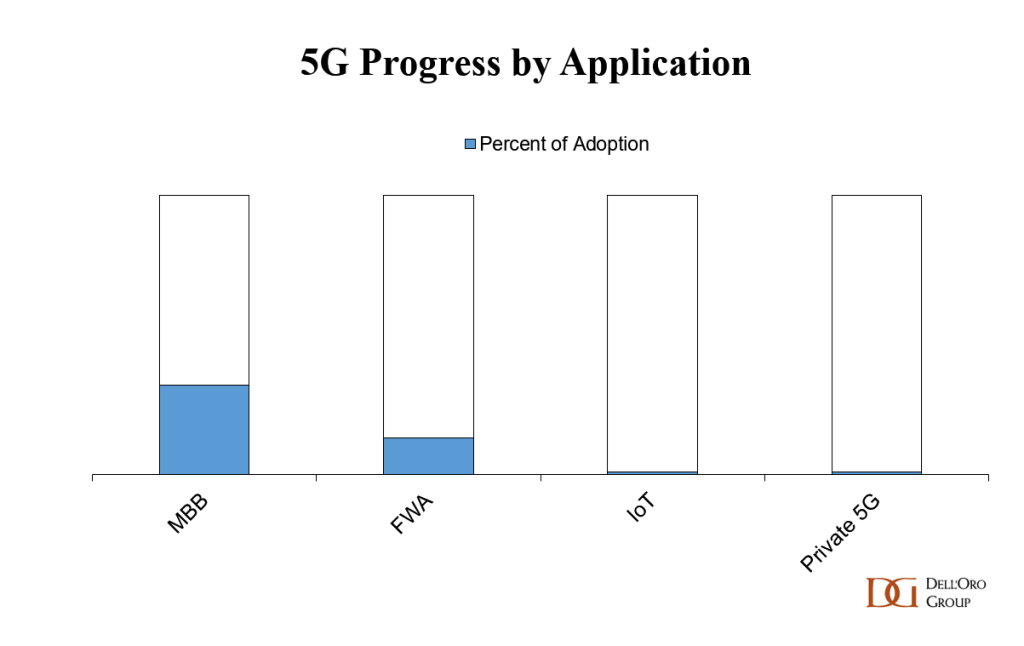

Worldwide, 786 Mobile Network Operators (MNOs) have launched public 4G SA eMBB services, and about 200 of these have commercially deployed 5G NSA eMMB services (Source: GSA, April 2023). As of June 2023, Dell'Oro Group counts 43 MNOs implementing 5G SA eMMB networks (Figure 2).

Worldwide, 786 Mobile Network Operators (MNOs) have launched public 4G SA eMBB services, and about 200 of these have commercially deployed 5G NSA eMMB services (Source: GSA, April 2023). As of June 2023, Dell'Oro Group counts 43 MNOs implementing 5G SA eMMB networks (Figure 2).

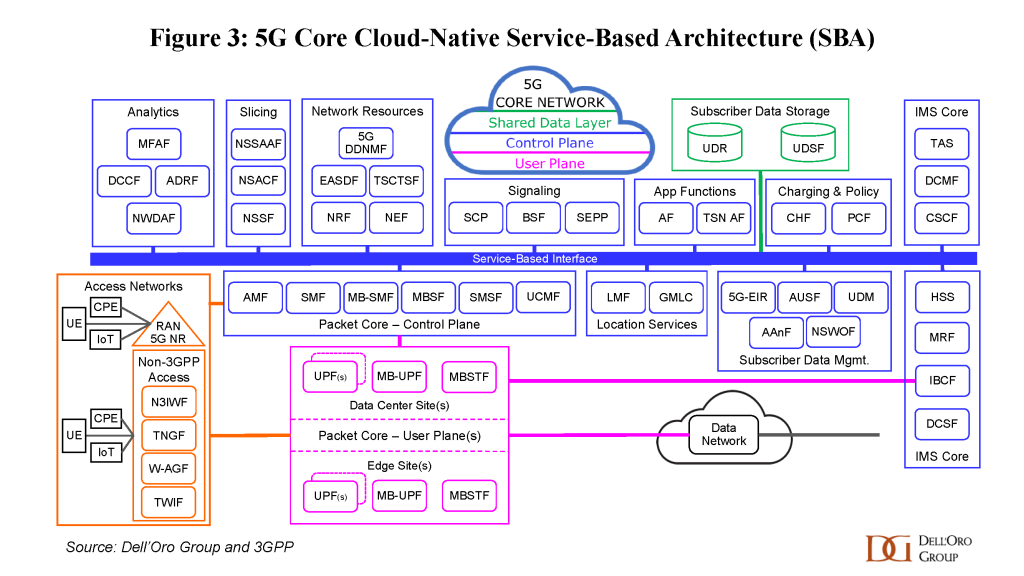

5G Core

5G SA is the most challenging path for migrating to 5G. To walk this path, MNOs must transform their legacy LTE networks with EPC—which may have Physical Network Functions (PNFs) or Virtual Network Functions (VNFs) with a reference point architecture—to 5G SA networks with the 5G Core. The 5G Core embodies a modern cloud Service Based Architecture (SBA) with container-based Cloud-Native Network Functions (CNFs) that can operate on virtual or bare metal servers (Figure 3).

To take advantage of the promise of 5G, MNOs and Enterprises must deploy 5G SA, with its modern 5G Core cloud architecture, so they can enable new services and use cases that are not necessarily available in 4G and 5G NSA networks. There are two primary requirements needed to facilitate new enterprise use cases: networks that are (1) private and, at the same time, (2) deterministic with low latency.

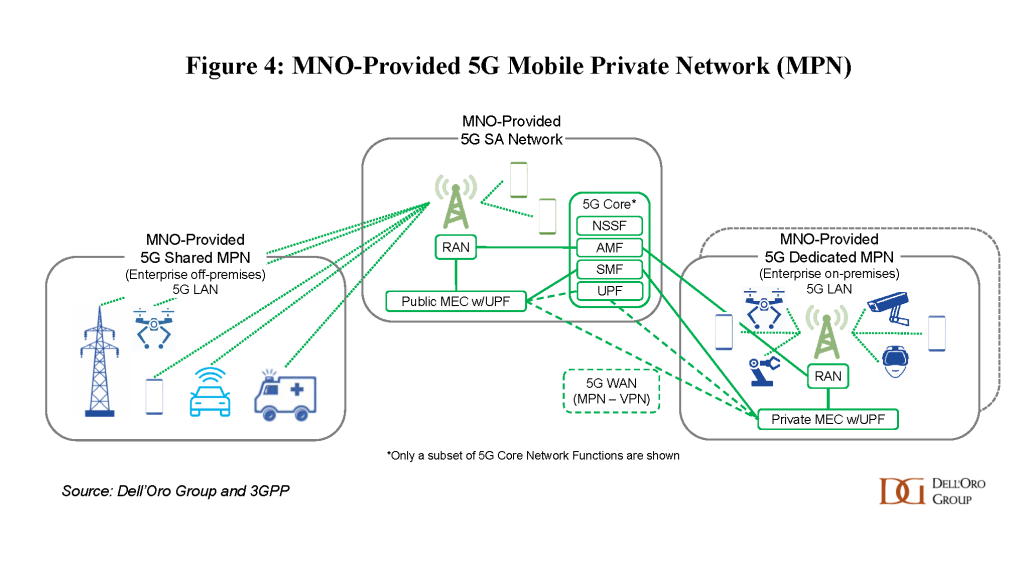

Figure 4 illustrates how MNOs can meet the needs of enterprises with Mobile Private Networks (MPNs) with the 5G SA network architecture. The lowest cost 5G MPN for an on-premises enterprise network is via an MNO-provided 5G Dedicated MPN (a.k.a., Public Network Integrated NPN (PNI-NPN)) with an MNO partner. A unique Data Network Name (DNN) for the on-premises RAN ensures network privacy. An on-premises Multi-Access Edge Computing (MEC) node, which includes the compute and storage for the enterprise use cases, provides low latency and data sovereignty. For enterprises that require off-campus geographic coverage, the 5G Shared MPN (a.k.a., PNI-NPN) offered by an MNO can meet the requirement for a private connection via the Network Slicing Selection Function (NSSF) for the RAN and Public MEC node.

The lowest cost 5G MPN for an on-premises enterprise network is via an MNO-provided 5G Dedicated MPN (a.k.a., Public Network Integrated NPN (PNI-NPN)) with an MNO partner. A unique Data Network Name (DNN) for the on-premises RAN ensures network privacy. An on-premises Multi-Access Edge Computing (MEC) node, which includes the compute and storage for the enterprise use cases, provides low latency and data sovereignty. For enterprises that require off-campus geographic coverage, the 5G Shared MPN (a.k.a., PNI-NPN) offered by an MNO can meet the requirement for a private connection via the Network Slicing Selection Function (NSSF) for the RAN and Public MEC node.

Over 10,000 MNO-provided MPNs have been implemented in China for various enterprises and institutions, with very few MNO-provided MPNs implemented outside China. Thanks to the broad implementation of Public Multi-Access Edge Computing (MEC) nodes by China's MNOs, enterprises with geographic coverage requirements can now run low-latency applications for real-time and near real-time communications via the MNO-provided 5G Shared MPN. In addition, many Chines enterprises worked with China's MNOs, placing Private MEC nodes on-premises at their physical locations; this enabled low-latency applications on campus via an MNO-provided 5G Dedicated MPN. In China, over 50 industries have now implemented low-latency applications in an MNO-provided 5G MPN environment.

In addition, over 800 enterprises in China have multiple campuses with 5G connectivity. Therefore, they leverage the 5G Wide Area Network (WAN), which enables high throughput Virtual Private Networks (VPNs) operating through the MPN intranet (MPN-VPN). Conventional VPNs must be routed through third-party servers to connect to the Internet; this lowers the downlink speeds and adds latency to the connection. In contrast, the downlink rate of MPN-VPNs is three times higher, and MPN-VPNs also have a 50% lower latency advantage for content traveling within the MNO's intranet. The 5G Core offers the important advantage of enabling the 5G WAN with a mesh architecture of the distributed User Plane Functions (UPFs).

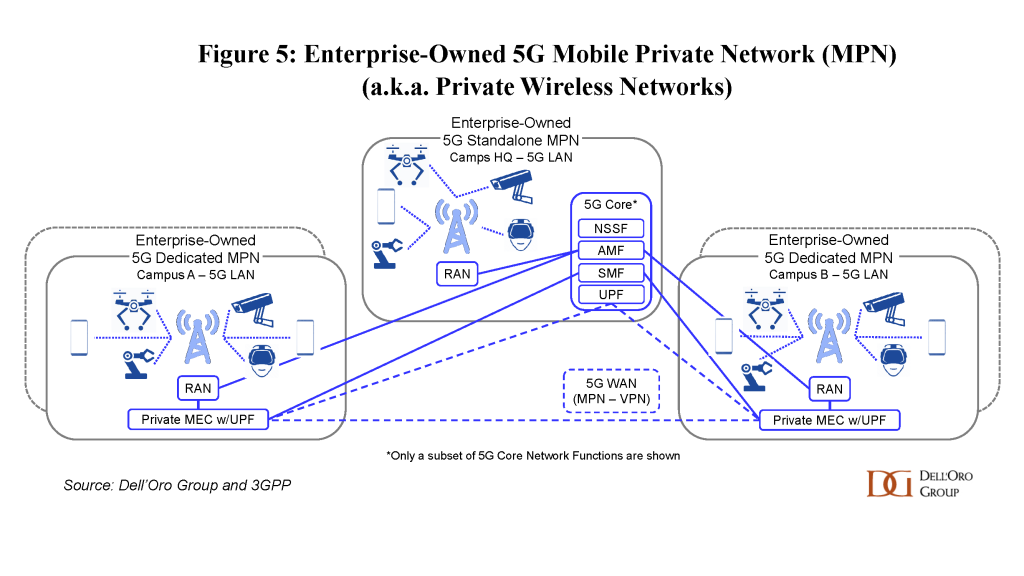

The most straightforward way to meet the requirements for high throughput and low latency is for enterprises to build and operate 5G Standalone MPNs (a.k.a., Standalone Non-Public Networks (SNPN)). But, building and operating 5G SA MPN requires more capex and management know-how than an MNO-provided 5G MPN. For enterprises that lack the management know-how, outsourcing the construction and operation of their networks will increase their costs (Figure 5). According to GSA's May 2023 Private Mobile Networks report, there are 275 Enterprise-owned 5G MPNs worldwide, and 230 Enterprise-owned 4G + 5G MPNs worldwide, totaling 505 Enterprise-owned 5G MPNs. However, most of these are Proof-of-Concept (PoC) or field trials. They are located primarily outside of China.

According to GSA's May 2023 Private Mobile Networks report, there are 275 Enterprise-owned 5G MPNs worldwide, and 230 Enterprise-owned 4G + 5G MPNs worldwide, totaling 505 Enterprise-owned 5G MPNs. However, most of these are Proof-of-Concept (PoC) or field trials. They are located primarily outside of China.

The rollout of 5G SA networks has been slow. 5G NSA and 5G SA were both standardized in 2018. In 2019, 5G NSA networks began rolling out, followed by 5G SA networks in 2020. As noted, there are over 200 5G NSA networks today, and just over 40 5G SA networks. Except for the MNOs in China, Shared and Dedicated MPNs by MNOs that include the new 5G features, like network slicing and MEC, have been slower to roll out. Also, enterprises’ 5G Standalone MPNs have yet to progress to the volumes as predicted several years ago. Indeed, the industry seems to be stuck in limbo, with enterprises repeating the same two- and three-year Proof of Concepts (PoC) for many of their applications. In other words, we have not yet seen the coming to fruition of:

-

-

- 5G Ultra-Reliable Low Latency Communications (URLLC)

- 5G Massive Internet of Things (MIoT)

- 5G High-Performance Machine-Type Communications (HMTC)

- 5G Vehicle-to-Everything (V2X).

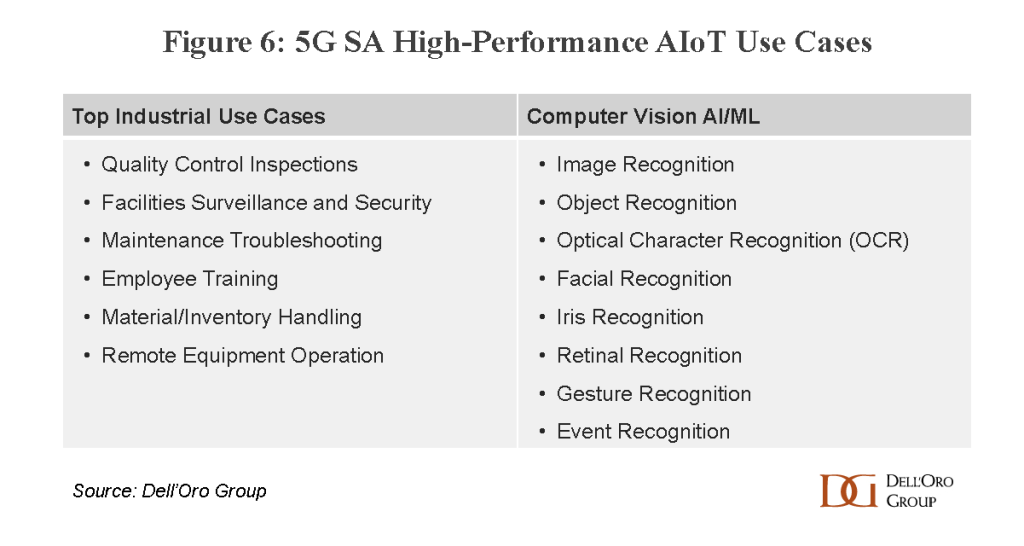

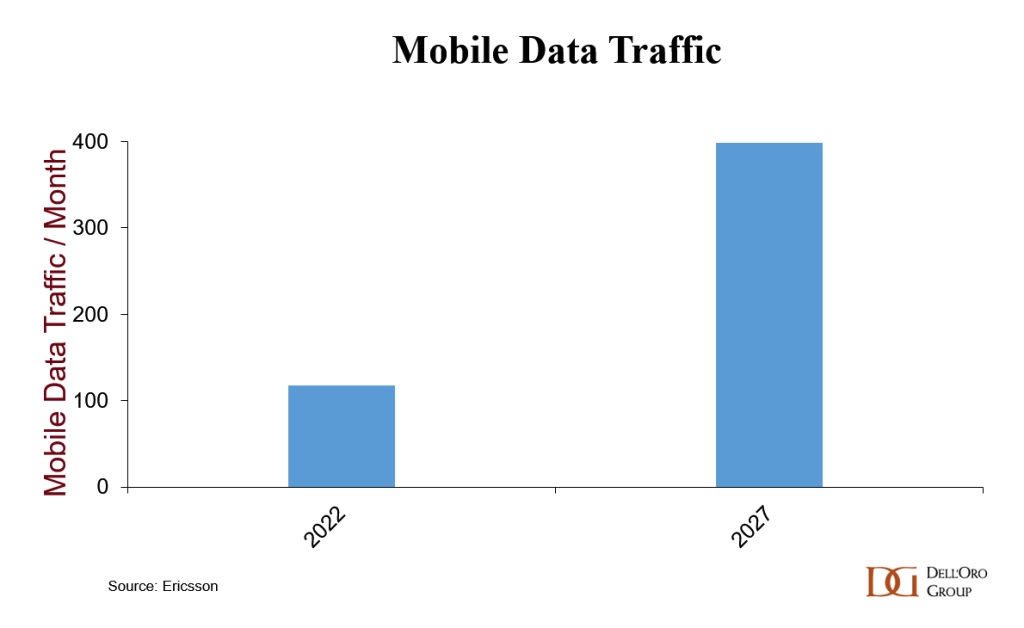

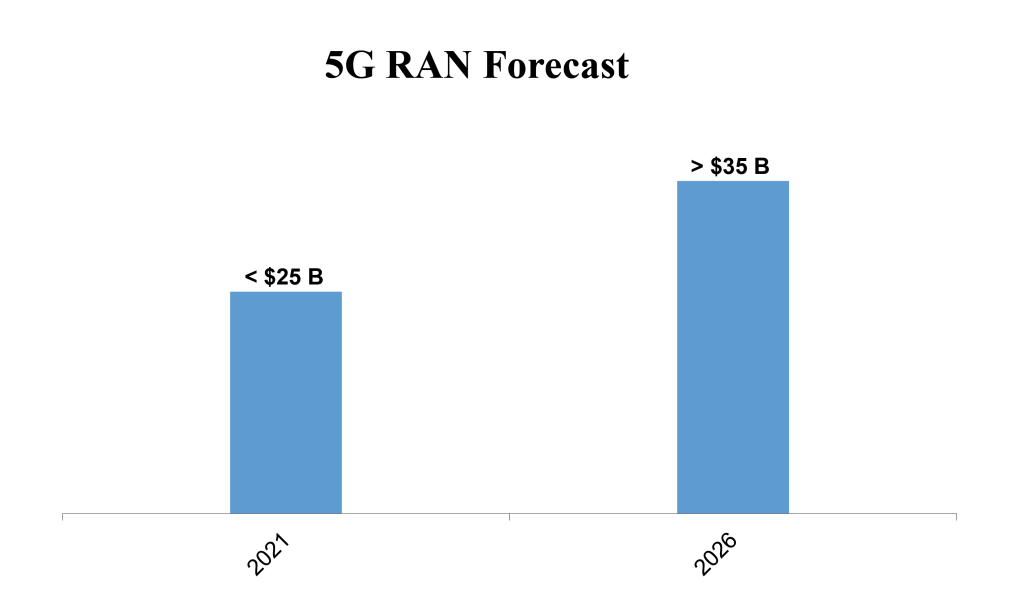

Industry forecasts of data growth are almost exponential, with no end in sight, driven by video. On the consumer side, streaming video and cloud gaming will be the drivers, and on the business side, applications enabled with Computer Vision will drive growth. Computer Vision is considered a "killer application" use case enabler, because of the many capabilities it has when coupled with the right AI/ML data analytics. Figure 6 lists top industrial use cases enabled by Computer Vision high-performance Artificial Intelligence of Things (AIoT) devices.

Eventually PoCs and trials will be completed, and Enterprises will start implementing these solutions. Some argue that 2023 will be a breakthrough year, during which more MNOs will launch 5G SA eMMB networks.

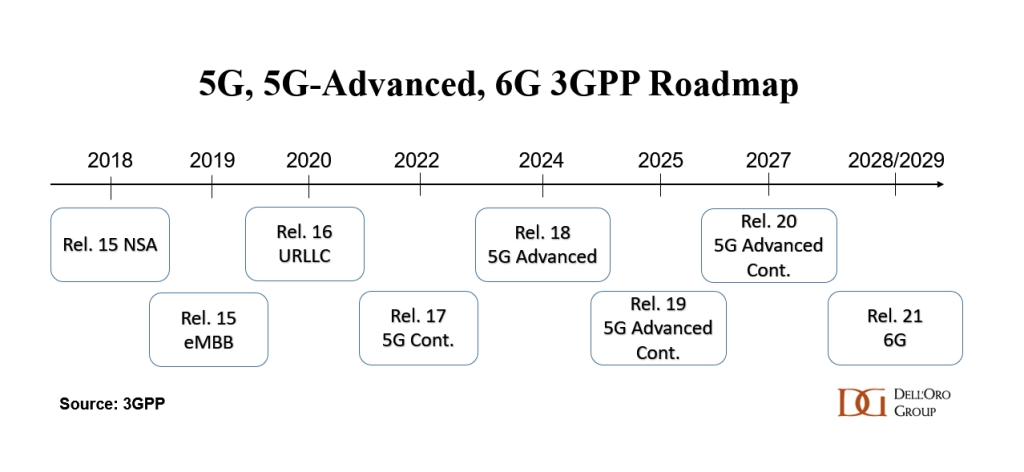

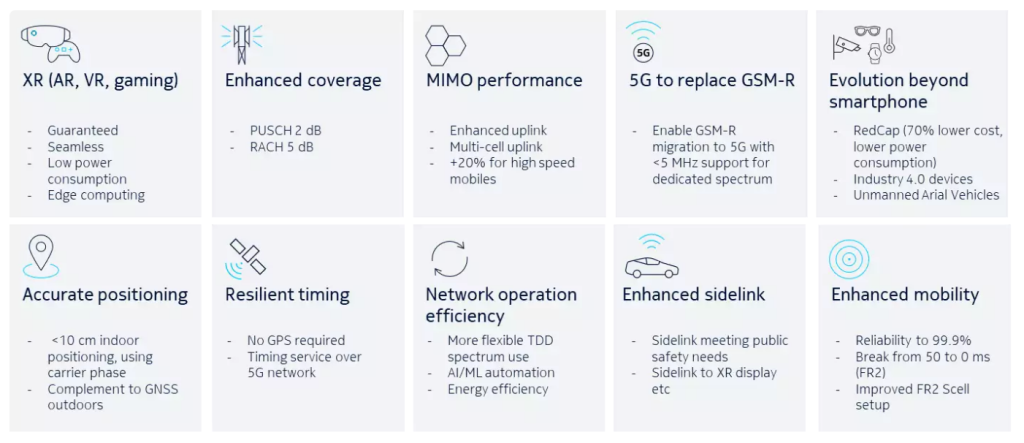

5G Advanced

Looking ahead to what comes next? 5G Advanced will emerge on the horizon, and it will enable vital new applications for the 5G Core. The 3GPP standards body defines 5G Advanced as Releases 18 and 19. No 3GPP specification will be 100% correct at inception. As lab, PoC, and field trials occur, the industry learns which refinements are necessary, and specifications are updated accordingly. Below is a list of advancements and new capabilities that are being defined and developed for Release 18 per 3GPP:

-

-

- XR (Extended Reality) and media services

- Edge Computing Phase 2

- System Support for AI/ML-based Services

- Enablers for Network Automation for 5G Phase 3

- Enhanced support of Non-Public Networks Phase 2

- Network Slicing Phase 3

- 5GC Location Services Phase 3

- 5G multicast-broadcast services Phase 2

- Satellite access Phase 2

- 5G System with Satellite Backhaul

- 5G Timing Resiliency and Time Sensitive Communications (TSC) and URLLC enhancements

- Extensions to the TSC Framework to support Deterministic Networking (DetNet)

- Evolution of IMS multimedia telephony service to SBA

- Personal IoT Networks

- Access Traffic Steering, Switching, and Splitting (ATSSS) support in the 5G system architecture Phase 3

- Proximity-based Services (ProSe) in 5GS Phase 2

- User Plane Function (UPF) enhancements for Exposure and SBA

- Generic group management, exposure, and communication enhancements

- 5G UE Policy Phase 2

- Uncrewed Aerial System (UAS), Uncrewed Aerial Vehicle (UAV), and Urban Air Mobility (UAM) Phase 2

- System Enabler for Service Function Chaining

- Seamless UE context recovery

- Multimedia Priority Service (MPS) when access to EPC/5GC is WLAN

3GPP's latest release is Release 18.1. The process will take us to the end of 2023 before Release 18 is frozen. Thus, we expect that more refinements and updates to the standards specifications included in Release 18 will be forthcoming.

Per 3GPP, early Release 19 studies include:

-

-

- Network of Service Robots with Ambient Intelligence

- Energy Efficiency as service criteria

- Upper layer traffic steering, switching, and split over dual 3GPP access

- Uncrewed Aerial Vehicles (Phase 3)

- Satellite Access (Phase 3)

- Roaming value added services

- AI/ML Model Transfer (Phase 2)

- Integrated Sensing and Communication

- Ambient power-enabled Internet of Things

- Localized Mobile Metaverse Services

- Network Sharing Aspects

- Future Railway Mobile Communication Systems (Phase 5)

- Supporting Railway Smart Station Services

3GPP will publish the explicit content of Release 19 in September 2023.

What trends can we foresee? While nobody's crystal ball is perfect, some trends that we anticipate, other than the Computer Vision AI/ML discussed above, include:

- Spatial Vision Technology

Spatial Vision Technology (a.k.a. naked-eye 3D) has caught the public's attention on massive new digital 3D billboards worldwide, like one in New York City, shown in Figure 7. Spatial Vision Technology provides an immersive 3D experience with the naked eye without needing VR glasses.

This concept has been around for almost a decade without achieving much commercial success. Still, with the advent of 5G and its high data throughput and low latency capability, new players are emerging to move this technology to the smartphone. It has already begun to emerge on laptop PCs, with the launch of two new laptops with 3D OLED screens from ASUS at CES 2023 in Las Vegas. These ASUS laptops may be the first to introduce naked-eye 3D on an OLED screen versus on an LED screen. Regarding a format that comes closer to a smartphone form factor, ZTE introduced a tablet with a 3D screen at MWC Barcelona 2023.

With any new display technology, such as HD, 4K, and 8K, generating new content can become a problem. In 2022, Huawei launched technology to convert 2D content to naked-eye 3D content, thus creating the required 3D content.

As naked-eye 3D technology takes off, processing that migrates network traffic from terminal rendering to cloud rendering will increase 3-fold to 10-fold.

Integrating the IMS Core into the 5G Core SBA will upgrade voice and video calling with new immersive capabilities, like Spatial Vision Technology. The IMS Core SBA introduces Data Channel Media Function (DCMT) and Multimedia Resource Function (MRF). Applications envisioned are real-time voice translations from one language to another (as Hollywood depicted in the Star Trek TV series with the "communicator" in the 1960s); visualized voice calling; and intelligent processing of media. The intelligent processing of media, such as audio streams and video streams during calls, means that new calls can realize the functions of changing backgrounds and avatars, and audio streams can be converted into subtitles. These new functions, once added to the IMS Core, will enable a much richer user experience with three-channel communication capability (audio, voice, interaction) and native AI real-time media processing.

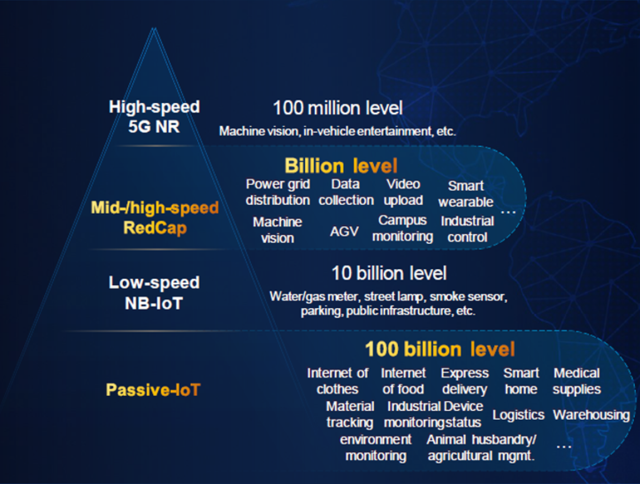

Though Reduced Capacity (RedCap) radios are not a 5G Core technology per se, they will reduce the cost and complexity of implementing IoT devices in a 5G SA network, thus enabling more use cases that the 5G Core will have to manage. One example noted in Figure 6 above is Artificial Intelligence of Things (AIoT); enterprises will use more AIoT devices with the introduction of RedCap-enabled AIoT devices.

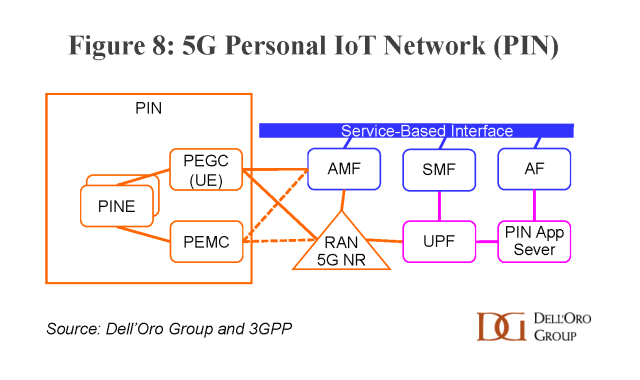

A Personal IoT Network (PIN) is a configured and managed group of PIN Element(s) (PINE) that can communicate with each other directly, communicate with each other via PIN Element(s) with Gateway Capability (PEGC), or use a PEGC to communicate with devices or servers that are outside the PIN via the 5G network. A PIN includes at least one PEGC and is managed by PIN Element(s) with Management Capability (PEMC). The PIN can also have a PIN Application Server with an AF functionality. The PEMC and PEGC communicate with the PIN Application Server at the application layer over the user plane. With these self-managing PINs, PINs will move the industry toward the Massive Internet of Things (MIoT) (Figure 8).

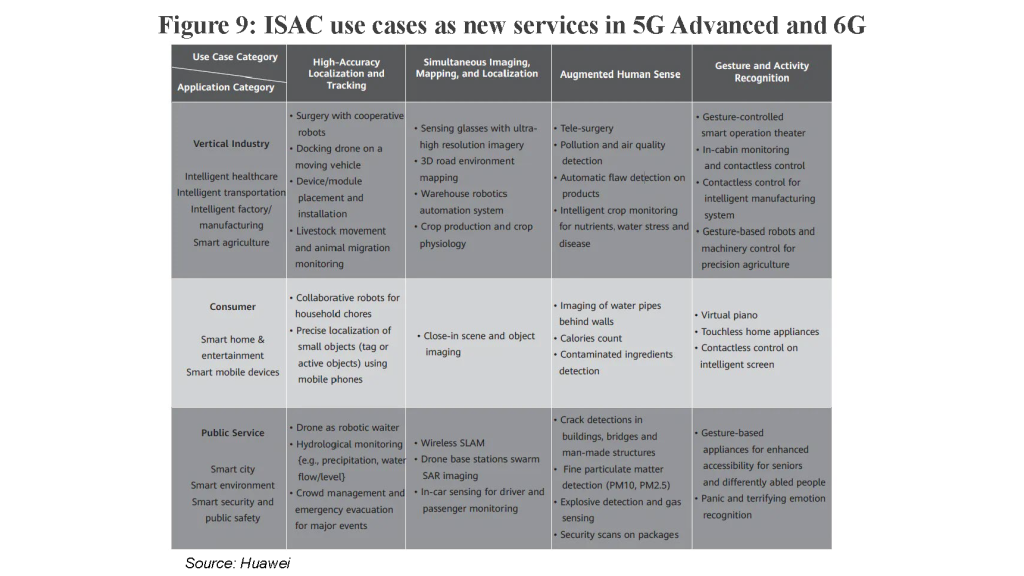

Integrated Sensing and Communications (ISAC) will enable ubiquitous IoT. New sensing capabilities beyond today's position sensing capability will be improved in 5G Advanced and will be further refined in 6G. Figure 9 categorizes use cases into four functional categories across different applications/industries.

-

-

-

-

- High-accuracy localization and tracking

- Simultaneous imaging, mapping, and localization

- Augmented human sensing

- Gesture and activity recognition

As 5G LANS are implemented, and different use cases are implemented within the same 5G LAN, the necessity for optimized UPFs arises. For Spatial Vision Technology and XR communications, a high-performance UPF will be required for a 10-fold increase in network traffic. For URLLC applications like Time Sensitive Networking (TSN), a special UPF will be necessary to handle higher concurrency connections and reliable and redundant backup without downtime. In addition, optimized UPFs are required for both media applications and MPN-VPNs.

- Artificial Intelligence/Machine Learning (AI/ML) Data Analytics

AI/ML are the engines behind the Data Analytics required to automate real-time and near real-time decision-making based on raw data from IoT sensors and devices. In the case of the 5G Core, the data will be generated by events coming from all of the network functions of Network Analytics provided by the Network Data Analytics Function (NWDAF). The sheer volume of data that may need to be analyzed—on the scale of petabytes—could never be handled manually. MNOs will need to adopt a mix of analytic approaches for consumer and industrial enterprise use cases based on data types, workloads, and the business problems that users are trying to solve. There are three categories of Analytics:

- Descriptive Analytics answers questions about what happened in the past

- Diagnostic Analytics offers insights into why those events happened

- Real-time Analytics (On-demand Analytics or Streaming Analytics) includes:

- Predictive Analytics analyzes current and historical data to provide insights into what might happen in the future

- Prescriptive Analytics suggests actions an organization could take based on those predictions

- Cognitive Analytics automates or augments human decisions

Examples of which use cases employ which kind of analytics include: 5G Network Analytics via MWDAF using Predictive Analytics, and Digital Twin modeling using Prescriptive Analytics.

Generative AI refers to a category of artificial intelligence (AI) algorithms that generate new outputs based on the data on which they have been trained. Unlike traditional AI systems that are designed to recognize patterns and make predictions, generative AI creates new content in the form of images, text, audio, and more.

Generative AI uses a type of deep learning called generative adversarial networks (GANs) to create new content. A GAN consists of two neural networks: a generator that creates new data and a discriminator that evaluates the data. The generator and discriminator work together, with the generator improving its outputs based on the feedback it receives from the discriminator until it generates content that is indistinguishable from real data.

Generative AI has a wide range of applications, including:

-

-

-

-

-

- Images: Generative AI can create new images based on existing ones, such as creating a new portrait based on a person’s face or a new landscape based on existing scenery

- Text: Generative AI can be used to write news articles, poetry, and even scripts; it can also be used to translate text from one language to another

- Audio: Generative AI can generate new music tracks, sound effects, and even voice acting

This section on generative AI was created using a language model AI trained by OpenAI. The AI was trained on a large dataset of text and was able to generate a new article based on the prompt given. In simple terms, the AI was fed information about what to write about and then generated the article based on that information.

Generative AI is a powerful tool that has the potential to revolutionize several industries. With its ability to create new content based on existing data, generative AI has the potential to change the way we create and consume content in the future

Whether it is creating new content with AI/ML or analyzing data with AI/ML, more compute power will be required, and if this compute power must meet certain latency requirements, AI/ML could drive up the demand for more edge computing or MEC.

Summary

While some believe that 5G SA and, subsequently, the 5G Core market and its associated applications, are developing slowly, we should remind ourselves that it is only the beginning of year 4 of a typical 10-year journey for a specific standard like 3G and 4G. 5G will have a journey similar to that experienced by 3G and 4G; namely, it will take about ten years before moving on to 6G. Because of the revolutionary move to a cloud-native service-based architecture, it may take a little longer for 5G to achieve the momentum that many anticipate. The good news is that 5G works. The lab, PoC, and field trials may take a little longer due to the nature of the technology and new use cases, but the technology is there. The 3GPP standards body has had a great vision, but it will take some time to bring it to commercial reality.

Related blogs: