But Market Growth is at Risk Due to Service Confusion

In 1880, Thomas Edison said “We will make electricity so cheap that only the rich will burn candles” and today, no enterprise can operate without power. Since the upheaval of a global pandemic, IT manufacturers are seeing Edison’s promise in a new light: converting Wireless LAN into a utility will accelerate enterprise productivity. Along the way, manufacturers stand to gain a steady stream of high-margin, recurring revenue.

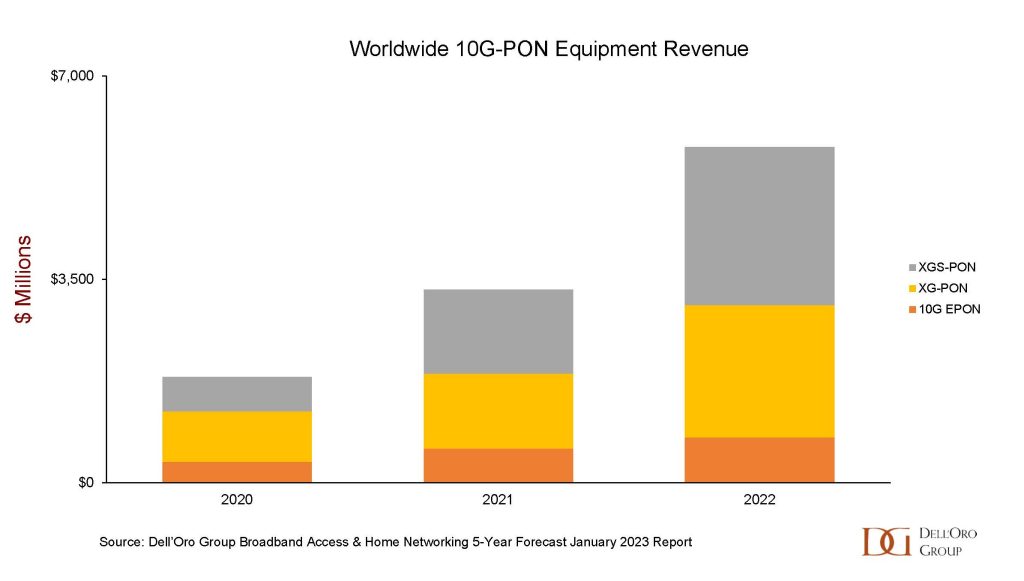

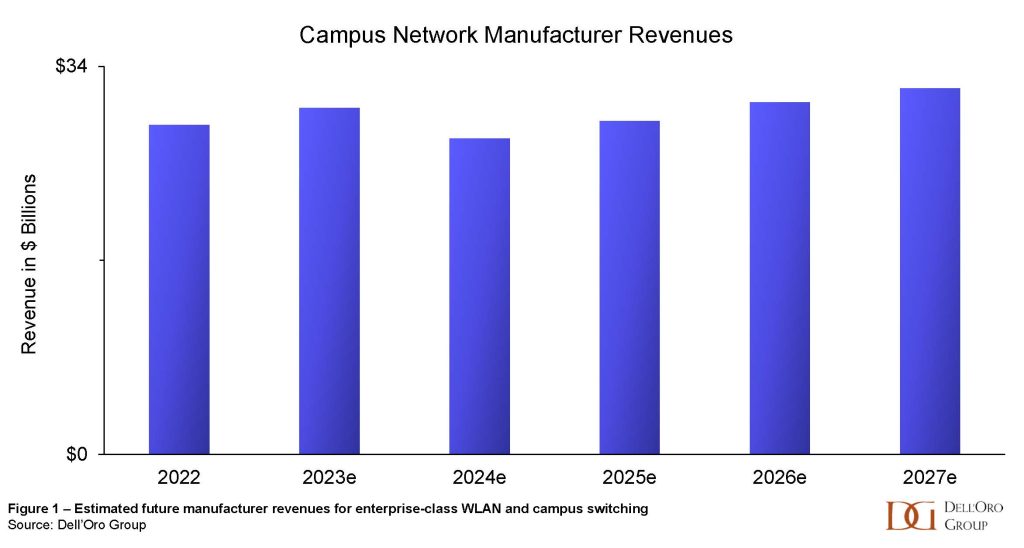

Manufacturers of Campus LAN equipment (enterprise-class WLAN and Switching) generated $29B of revenue in 2022 with an anticipated 5-year CAGR of 2%. New entrants believe the market is ripe for an innovative service offer and incumbents are looking to accelerate market growth.

The Vision is Compelling, but its Instantiation Remains Unclear

Industry visionaries have therefore married the vision of “Wi-Fi as a utility” with the cloud-enabled “As-a-Service” (aaS) technology abstraction to create a compelling proposition – but it is rare to find two manufacturers who describe the service in the same way. With each variation having different commercial, financial, and technological implications, it’s a complex landscape for IT departments to navigate.

And so, the killer question remains unanswered: Will the Enterprise Campus NaaS opportunity succeed in expanding the campus network market? Or will it be relegated to a differentiating feature of existing solutions, fueling competition without growing demand?

New entrants to the Enterprise Campus NaaS market believe the former proposition is true. They have developed cutting-edge technology and innovative commercial strategies to meet enterprises’ needs. Meanwhile, incumbent vendors’ are positioning services that have deep feature sets, well-developed channels, and strong brand awareness.

A common framework for defining Enterprise Campus NaaS is critical for manufacturers to quantify the market opportunity and hone their strategies. For the service to flourish, their customers’ IT departments must be able to understand and compare the available services.

Defining the Cloud Consumption Model in a Campus Context

The three words “As A Service”, or aaS, have become synonymous with the cloud computing model. The aaS extension is appended to different words (e.g. Infrastructure, Platform, Software) to denote different levels of technology abstraction. When applied to campus network IT, the cloud consumption mode is often called NaaS, or Network As-a-Service. This term lends confusion as it can also denote Wide Area Network services.

Since terminology matters when new markets are being developed, we define Enterprise Campus NaaS as the delivery of campus connectivity at Layer 2 and Layer 3 of the OSI model (such as WLAN and switching) within the premises of an enterprise or organization by means of a service that adheres –at least partially– to the cloud consumption model.

To provide a common framework for comparing the offers on the market, we define the four key parameters of the cloud consumption model below and explore how these can be instantiated in campus networks.

- Cloud Consumption Services Are Outcome-Oriented

With an outcome-oriented service, an enterprise no longer purchases technology. Instead, it purchases a service based on a result it expects to attain. For example, the Open Data Center Alliance has defined IaaS outcomes such as millions of IO operations, or GBs of disk capacity.

In a campus networking environment, an enterprise could purchase a solution defined by a consistent Wi-Fi signal level over a given area or a minimum download speed for a specified number of devices. However, due to the complexity of these models, many Enterprise Campus NaaS providers opt to structure their service around the underlying technology, charging a fee based on the number of APs or ports.

A truly outcome-based Enterprise Campus NaaS must be accompanied by an enforceable Service Level Agreement, which remains another impediment. Manufacturers are well aware of the challenges and costs associated with implementing SLAs.

- The Cloud Consumption Model is Elastic

An elastic “aaS” offer appears infinite. The purchaser of PaaS is not bound by the fixed dimensions of a server or hard drive; the service provider ensures the capacity and desired reliability are available.

For a university whose students have just discovered the latest bandwidth-hogging application, an elastic Enterprise Campus NaaS would absorb the unexpected traffic peaks with no costly design changes or additional hardware.

However, the tight coupling between WLAN hardware and its physical installation represents a challenge for service providers. Some of the offers on the market are designed to have a certain elastic nature, but their upper limits will remain constrained by the on-premises hardware installed.

- Cloud Consumption Services have a Recurring Price Structure

In its simplest form, Enterprise Campus NaaS, is priced with a subscription fee: a conversion of capital cost (of APs and switches) to a recurring, operational expense.

This can be attractive for a distributed retail operation opening a new store, whose large, up-front cost of the network infrastructure disappears. The new location would increase the company’s IT bill in the same proportion as existing locations, simplifying cost attribution and recovery. In these types of service offers, the cost of financing the hardware is often blended into the monthly price.

For “aaS” offers that are also elastic and outcome-oriented, another commercial structure becomes a possibility: consumption-based pricing. With this model, a university network that benefited from an Enterprise Campus NaaS would have hardware in place for near-infinite usage, but the monthly bill would dip down in the quiet summer months.

Given the large cost of network hardware on premise, manufacturers may find it difficult to charge true consumption-based pricing. Enterprises will have to commit to prescribed contract lengths or minimum monthly charges, even if the service price varies somewhat according to usage.

- Cloud Consumption Services are Maintenance-Free

Whether it’s IaaS, PaaS, or SaaS, hardware maintenance is performed by the service provider. For Enterprise Campus NaaS, maintenance, or life-cycle, services are the blurriest of the cloud consumption parameters.

Traditionally, campus IT manufacturers have shied away from delivering ongoing life-cycle services, avoiding direct competition with MSPs, their valued channel partners. However, last year Home Depot announced it was outsourcing portions of its campus network operations to HPE, whose executives have been emphasizing the long-term profitability of “aaS” offers. In contrast, Juniper Mist and Cambium Network’s Enterprise Campus NaaS announcements focus on enabling their channel partners.

Whereas new entrant Shasta Cloud is promising to revolutionize the way MSPs deliver Enterprise Campus NaaS to their clients, startups Nile and Meter are focused on delivering the full gamut of life-cycle services directly, as well as via channel partners.

The most difficult phase of the technology life-cycle to include in Enterprise Campus NaaS is the hardware end-of-life. A truly “evergreen” service, would include hardware upgrades as the 802.11 standards evolve –without an enterprise paying for them outright– but Enterprise Campus NaaS is still too new to have put this phase to the test.

Related Blog: The Role of Ethernet in Wi-Fi as a Utility (written by David Rodgers, EXFO; published by Ethernet Alliance)

How is the industry positioning Enterprise Campus NaaS?

Over the past 6 months, we have interviewed over a dozen industry participants who have commercialized, or are planning on commercializing, some type of Enterprise Campus NaaS. A minority of the services met all of the cloud consumption characteristics. However, all of the services met at least one criteria, with subscription-based pricing being the most popular. Fewer than a third of the Enterprise Campus NaaS offers had some form of elasticity or contained an evergreen provision to upgrade hardware at no additional cost.

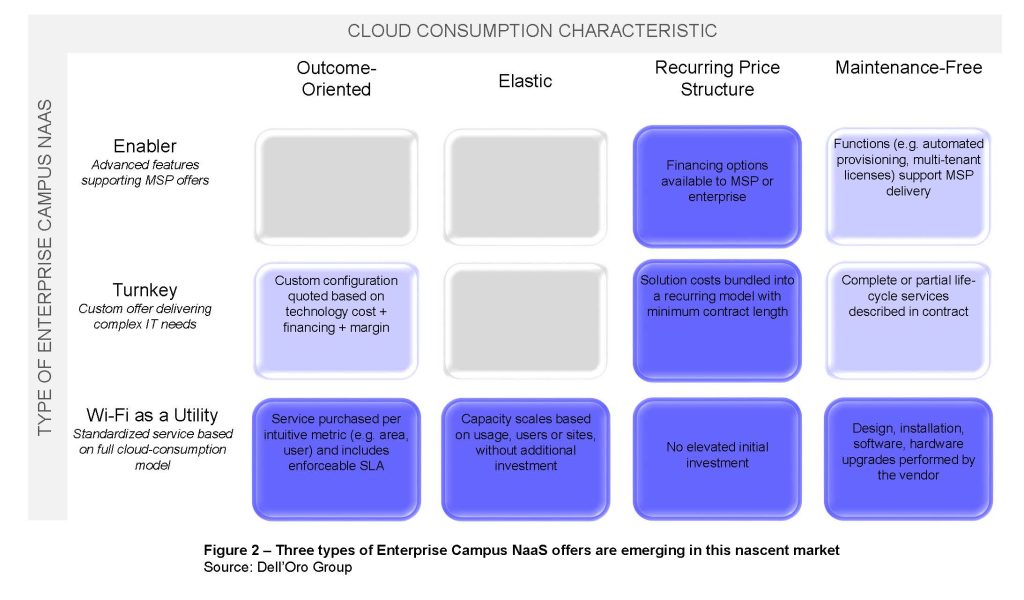

With industry players approaching Enterprise Campus NaaS from different angles, it follows that their commercial strategies vary, with a focus on different customer verticals, segments and channels. However, there are three broad categories of Enterprise Campus NaaS that are beginning to emerge. As the market matures we expect to see vendor strategies consolidate according to which of the three types of Enterprise Campus NaaS they envision: Enabler, Turnkey, or Wi-Fi as a Utility, as depicted below.

Those who are navigating the complex Enterprise Campus NaaS landscape can look to history, at the evolution of the electrical power grid. Thomas Edison chose to back a power distribution system based on Direct Current —convinced that Alternating Current transmission systems were too dangerous to the public. The competing models battled it out for over a decade before Edison Electric merged to form General Electric, and AC distribution became the worldwide standard.

Enterprise Campus NaaS brings the allure of easy-to-manage, ubiquitous WLAN at a time when businesses depend on wireless connectivity more than ever. However, to effectively market the service, the industry needs to converge on some common definitions. Once that happens, enterprises will be able to take their Wi-Fi coverage for granted, thinking about it as much as they think about electricity — about once a quarter, when they pay their bill.

More information on the different approaches to Enterprise Campus NaaS and a quantitative analysis of the market will be included in the advanced research report entitled Campus NaaS and Public Cloud-Managed LAN, to be released in June 2023.