[wp_tech_share]

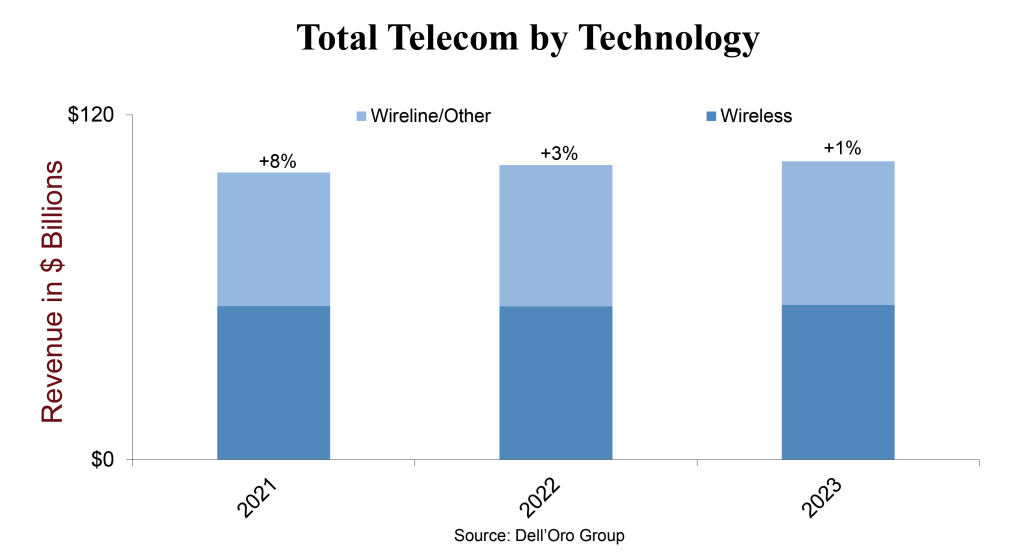

We just returned from MWC after a couple of intense days of meetings. RAN might not be the fastest growing market but from a technology perspective, the pace of change simply remains impressive and the MWC is a great event to witness the progress. Although we are not the right source to capture all of the PR activity involving incremental product announcements, we want to point out a few RAN-related observations that could potentially impact the RAN forecast or vendor dynamics.

Virtualized RAN is gaining momentum

As we now know, vRAN started out slow but picked up some speed in 2022 in conjunction with the progress in the US. The challenge from a forecasting perspective is that the visibility beyond the greenfields and the early brownfield adopters is limited, primarily because purpose-built RAN still delivers the best performance and TCO. As a result, there is some skepticism across the industry about the broader vRAN growth prospects.

During MWC, we learned four things: 1) Near-term vRAN visibility is improving – operators in South Korea, Japan, US, and Europe are planning to deploy vRAN in the next year or two. 2) vRAN performance is firming up. According to Qualcomm, Vodafone (and Qualcomm) believes the energy efficiency and performance gap between the traditional and new Open vRAN players is shrinking (Vodafone publicly also praised Mavenir’s OpenBeam Massive MIMO AAU). Samsung also confirmed (again) that Verizon is not giving up any performance with Samsung’s vRAN relative to its purpose-built RAN. 3) vRAN ecosystem is expanding. In addition to existing vRAN suppliers such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia announcing improvements to their existing vRAN/Cloud RAN portfolios, more RAN players are jumping on the vRAN train (both NEC and Fujitsu are expecting vRAN revs to ramp in 2023). And perhaps more interestingly, a large non-RAN telecom vendor informed us they plan to enter the vRAN market over the next year. 4) The RAN players are also moving beyond their home turf. During the show, Nokia announced it is entering the RAN accelerator card segment with its Nokia Cloud RAN SmartNIC (this is part of Nokia’s broader anyRAN strategy).

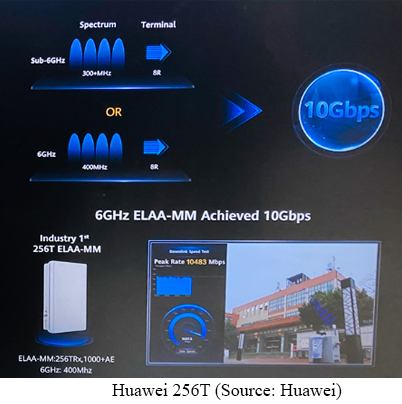

256T256R Massive MIMO

For a technology that was initially viewed as being mostly fit for high-traffic locations, Massive MIMO has come a long way in just a few years, ramping at a much faster pace than initially expected. As we recently outlined in the Massive MIMO 2022 blog, the days of exponential growth are in the past but there is still Massive MIMO upside ahead to support TDD MBB expansions in the less advanced markets, FDD hotspot deployments, FWA, and TDD product refresh to take advantage of continuous product improvements such as wider IBW, lower power consumption, smaller form factors, and more transceivers/antenna elements.

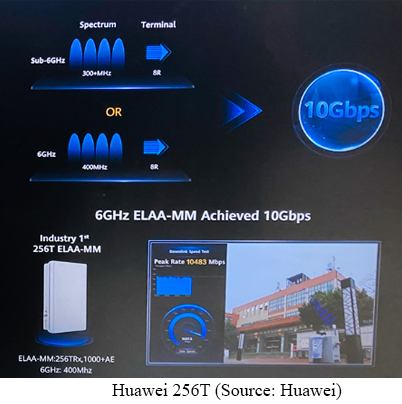

With limited new sub-7 GHz spectrum on the horizon, improving the spectral efficiency using more didoes and transceivers will continue to play a fundamental role with 5G, 5G-Advanced, and 6G. This is not a surprise. However, since we previously assumed the 128T128R would be the de-facto configuration for the 6 to 7 GHz band, it was somewhat surprising to see Huawei’s 256TRx prototype in the booth (ZTE had a 128T128R AAU in its booth).

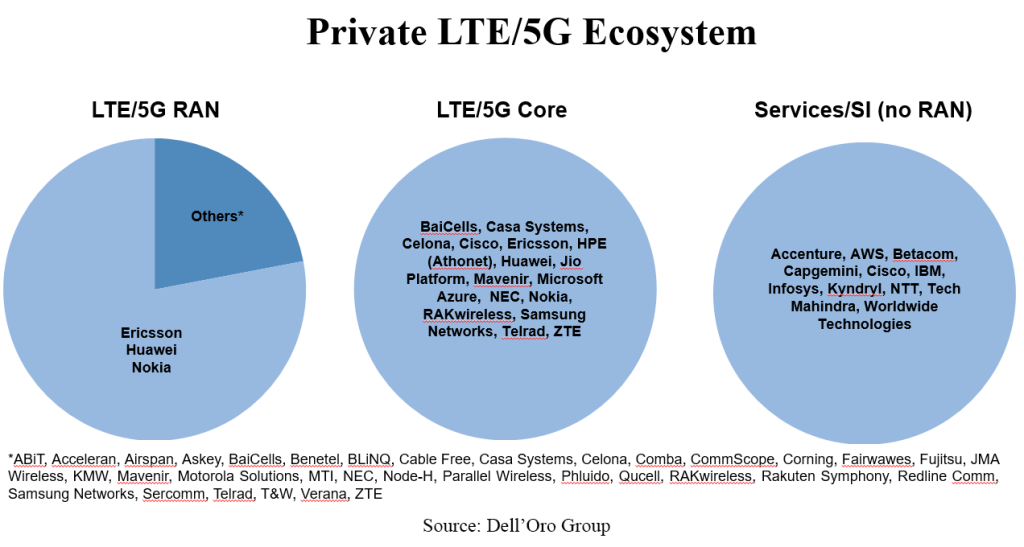

Private 5G ecosystem is evolving

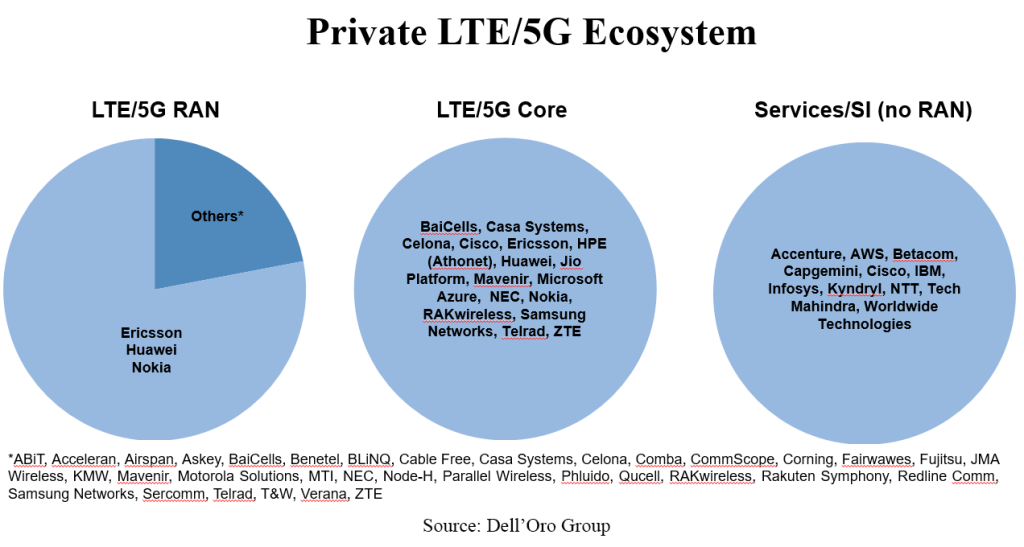

Private 5G is running behind schedule. We recently adjusted the private wireless forecast downward to reflect the current state of the market. Still, the slow uptake is not dampening the enthusiasm for private wireless. If anything, the interest is growing and the ecosystem is evolving as suppliers with different backgrounds (RAN, core, Wi-Fi, hyperscaler, in-building, SI) are trying to solve the enterprise puzzle. Below is a summary of the private RAN, core, and SI/services providers that we are currently monitoring.

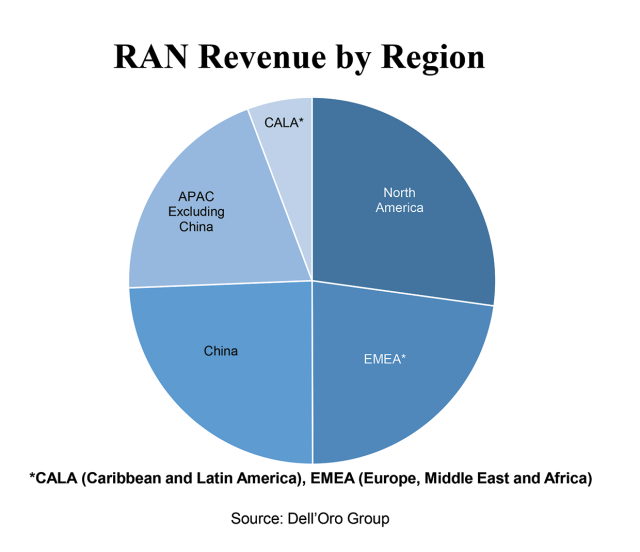

More suppliers want a piece of Europe

Per our 4Q22 RAN report, Ericsson, Nokia, and Huawei collectively accounted for around 95% of the European RAN market in 2022. Other RAN suppliers have tried to expand their respective footprints over the past couple of years without much success. One of the takeaways from the MWC discussions is that activity with the smaller suppliers is on the rise:

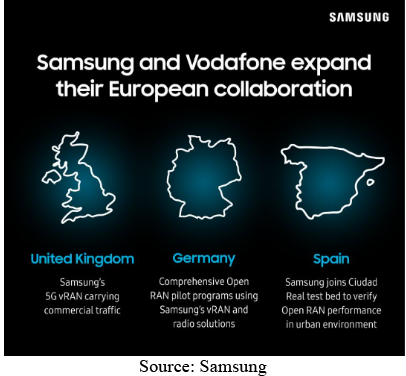

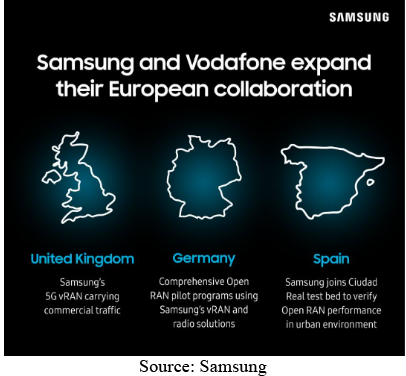

- Samsung highlighted its vRAN/Open RAN progress with Vodafone in the UK, Germany, and Spain and remains optimistic its European RAN revenues will soon become more material.

- NEC started recognizing European RAN revenues in 2022 (primarily driven by 1&1 in Germany).

- Fujitsu believes its European RAN growth prospects will improve in 2024.

- Mavenir has 10 K brownfield Open RAN sites in the pipeline for 2023/2024 – Deutsche Telekom is part of the mix, however, the exact upside in Europe remains unclear.

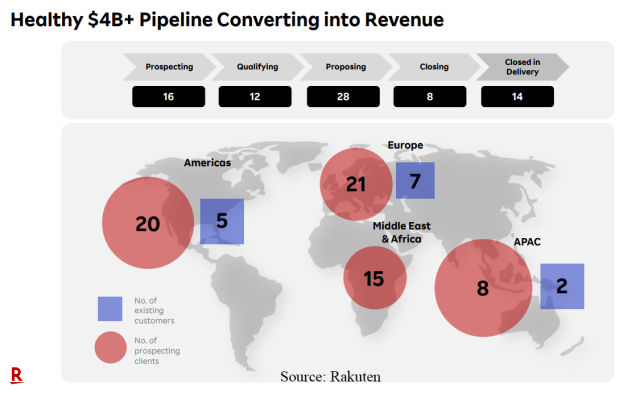

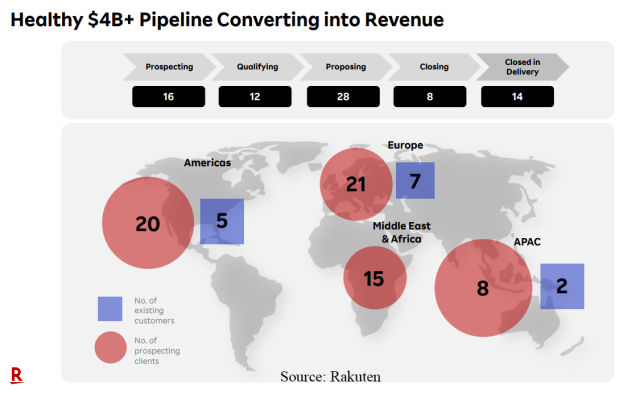

- Rakuten Symphony recently estimated its Open RAN pipeline is worth around $2B (half of the total pipeline). We don’t know the size of the European component. However, the company recently reported that nearly half of the # (not value) of prospecting clients (for RAN and non-RAN) are located in Europe per the chart below.

|

|

While it is unlikely that management over at Ericsson, Nokia, and Huawei are losing a ton of sleep at this juncture from these announcements, it might be worthwhile to check back in a year if the collective share of the top 3 is still around 95%.

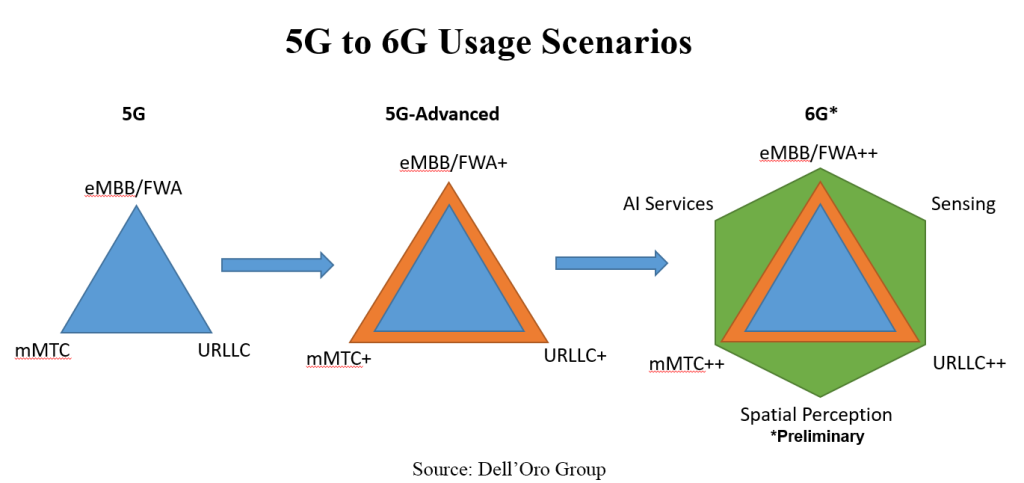

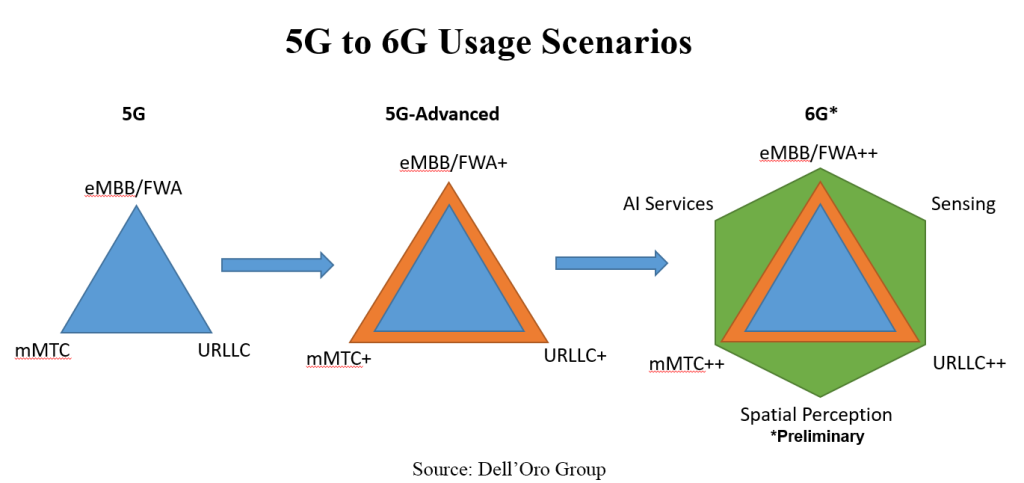

Skepticism is on the rise

Not surprisingly, disconnects between vision and reality are common when new technologies are introduced. Even if this is expected, we are sensing more frustration across the board this time around, in part because RAN growth is slowing and 5G still has mostly only delivered on one out of the three usage scenarios outlined in the original 5G use case triangle. With 5G-Advanced/5.5G and 6G starting to absorb more oxygen, people are asking if mMTC+/mMTC++ and URLLC+/URLLC++ are really needed given the status of basic mMTC and URLLC. Taking into consideration the vastly different technology life cycles for humans and machines, there are more questions now about this logic of assuming they are the same and will move in tandem. If it is indeed preferred to under-promise and over-deliver, there might be some room to calibrate the expectations with 5G-Advanced/5.5G and 6G.

And most importantly, this was our first live MWC event since 2019. It was great to be back and meet people in person without any Covid restrictions. The energy level at the show was amazing – now if this energy could somehow start showing in the RAN numbers, that would be even more exciting.

There were a number of announcements by service providers confirming that 1.2 Tbps-capable devices are ready, and that they themselves were looking forward to these new high-performance transponders. Three of those announcements were as follows:

There were a number of announcements by service providers confirming that 1.2 Tbps-capable devices are ready, and that they themselves were looking forward to these new high-performance transponders. Three of those announcements were as follows: