With 2022 now almost in the rear-view mirror, the timing is right to review how the RAN market is unfolding, and more importantly, what is on the horizon for 2023. In this blog, we will review three projections regarding the overall RAN market, 5G, and Open RAN.

1) Total RAN to decline in 2023

In retrospect, the market has evolved over the past year. Going into 2022, we projected that the RAN market would advance at a mid-single digit rate in 2022 in nominal USD terms, supported by strong growth in North America and modest growth in China, Europe, and other parts of the Asia Pacific.

While we don’t have the complete picture yet as we only have data for the 1Q22-3Q22 period, it is safe to assume that the high-level projections for both China and North America were reasonable, barring any major 4Q22 surprises. Still, we also need to recognize that RAN investments in Europe and Asia Pacific excluding China are tracking below our projections for the 1Q22-3Q22 period.

This gap in the output acceleration is primarily driven by forex fluctuations and prices – base station volumes and overall 5G activity are mostly in line with expectations, but the revenue per base station was impacted as the USD gained against most major currencies throughout 2022.

As we look into 2023, the regional mix will evolve. India, which is a smaller part of the RAN market in 2022, will be one of the bright spots going forward. Per our recently published 5-year RAN forecast, we are modeling an intense 5G deployment phase over the next 3 years, and this will already show up in the numbers this year and almost be enough to offset more challenging comparisons in North America and China.

2) 5G RAN will grow at a double-digit rate in 2023

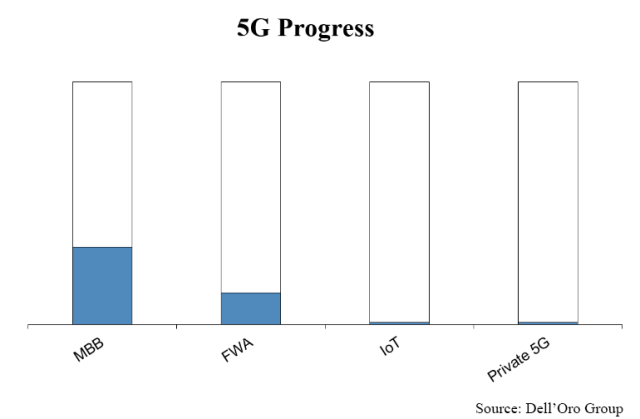

As we now know, 5G investments have increased at a remarkable pace since the first NR networks were launched back in 2018, resulting in a 5G ascent that has been much steeper and broader relative to what we experienced with previous technology shifts. The challenge now is that the 5G comparisons are becoming more challenging in the advanced markets. And the implications are that 5G RAN growth rates will subside somewhat going forward.

At the same time, our long-term thesis still holds. We are still in the early days of the broader 4G-to-5G transition and incremental capex will be required beyond the initial coverage layer to support all the frequency flavors and use cases. In other words, the days of exponential 5G RAN growth are clearly in the past, however, 5G RAN revenues are still expected to advance at a double-digit rate in 2023.

3) Open RAN to account for 6% to 10% of RAN Market in 2023

The Open RAN movement has come a long way in just a few years, propelling Open RAN revenues to accelerate at a faster pace than initially expected. Going into 2022, we projected Open RAN would comprise around 3% of the full-year 2022 market. Per our 3Q22 RAN report, our analysis indicates Open RAN revenues surged at a much steeper pace than expected spurring Open RAN to comprise a mid-single digit share of the full-year capex.

Meanwhile, the underlying message that we have communicated now for some time has not changed. The early adopters are embracing the movement, however, there is more uncertainty when it comes to the early majority operator and the impact on the supplier dynamics. Per the 3Q22 RAN report, the rise of Open RAN has so far had limited impact on the broader RAN market concentration—we estimate that the collective RAN share of the top 5 RAN suppliers declined by less than one percentage point between 2021 and 1Q22–3Q22.

Still, our position remains unchanged. Even with the underwhelming progress by the smaller Open RAN focused suppliers and the challenges ahead to cross the chasm, we believe this will not be enough to derail the movement toward openness. Following the surge in 2022, Open RAN radio revenue growth will slow in 2023, reflecting a more challenging comparison with the early adopters.

In short, it will be an interesting year. As with any forecast, there are risks. Please come back as we update the RAN analysis to reflect all the latest developments.