The concept of utilizing private cellular networks—also known as non-public networks (NPNs)—for the sole use of a private entity, such as an enterprise or government, is far from new. In fact, the industry has gone through various private enterprise hype cycles over the past decade. And while there are already thousands of commercial private networks in service across the globe, it would be a stretch to suggest the commercial private 5G RAN market has surprised on the upside from a revenue perspective. With activity on the rise, the time is right to review private wireless definitions, current market status, and progress towards the forecast.

What is Private Wireless?

One of the challenges with the private wireless concept is that it is not a specific technology but rather more of a broad term encompassing a wide range of technologies. Marketing departments will have some wiggle room, as the meaning of private wireless varies significantly across the ecosystem.

Some Wi-Fi suppliers, for example, believe they provide private wireless connectivity to enterprises. Smaller radio access network (RAN) suppliers without macro footprints typically associate private wireless with dedicated standalone connectivity for enterprises, while some of the more established macros RAN suppliers envision private wireless as encompassing a broader set of technologies, including both macro and small cell networks.

Suppliers focused on mission-critical and public safety networks see private LTE and NR combined with a new spectrum as an opportunity to upgrade existing private narrowband communications equipment. With the number of LoRa end nodes surpassing 0.2 B, LoRa base station suppliers believe they are dominating the private wireless IoT market.

The operators are also positioning the concept differently, with some focusing on the benefits with broader coverage, while others are capitalizing on some of the new local concepts.

While definitions or interpretations vary widely on the part of both suppliers and operators, there appears to be a greater consensus among customers.

For end-users, private wireless typically means consistent, reliable, and secure connectivity, not accessible by the public, to foster efficiency improvements. For industrial sites, private wireless typically means low latency and high reliability. It is less about the underlying technology, spectrum, or business model and more about solving the connectivity challenge. In other words, end-users don’t care what is under the hood.

From a Dell’Oro perspective, we consider private wireless as nearly synonymous with 3GPP’s vision for NPNs. According to 3GPP, NPNs are intended for the sole use of a private entity, such as an enterprise. NPNs can be deployed in a variety of configurations, utilizing both virtual and physical elements located either close to or far away from the site. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), be hosted by a PLMN, or be deployed as completely standalone networks.

From an end-user perspective, private wireless is also a broader term, generally including not just the RAN but also transport, mobile core network (MCN), Multi-Access Edge Computing (MEC), and corresponding services.

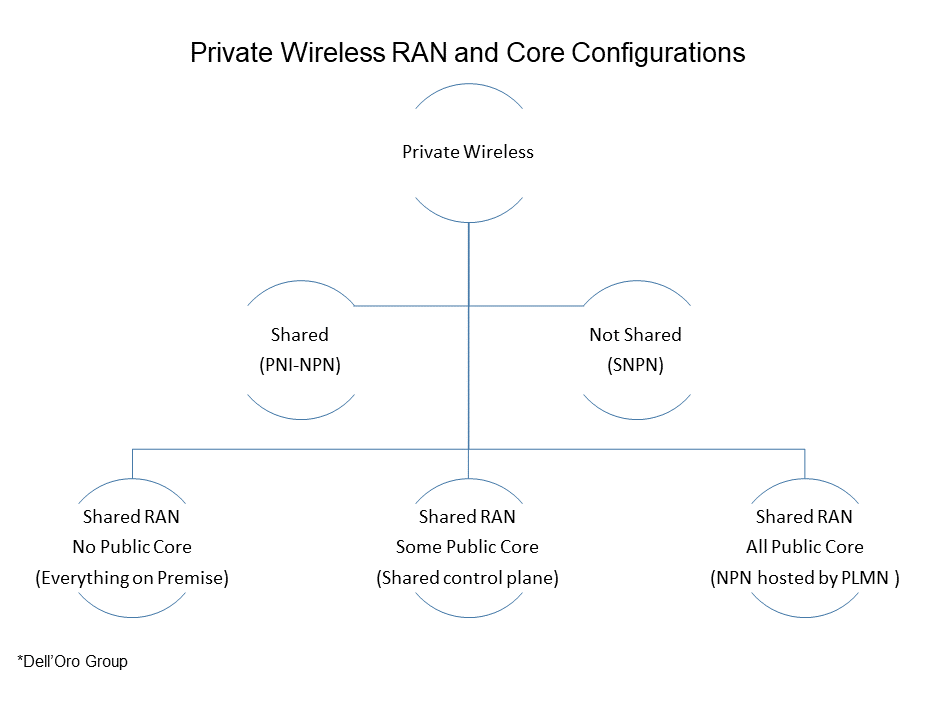

Private Wireless RAN and Core Configurations

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models.

At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares the resources between the private and public networks.

- Not Shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Market Status

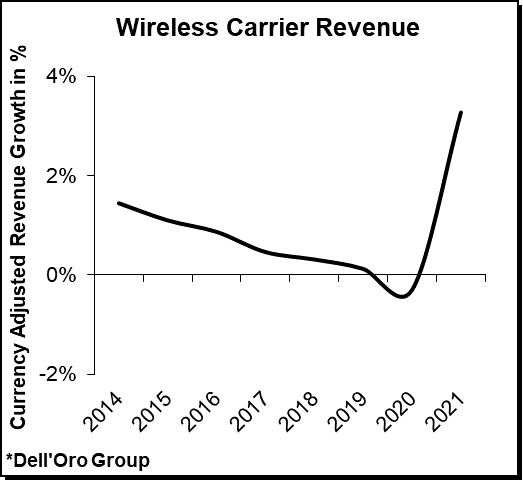

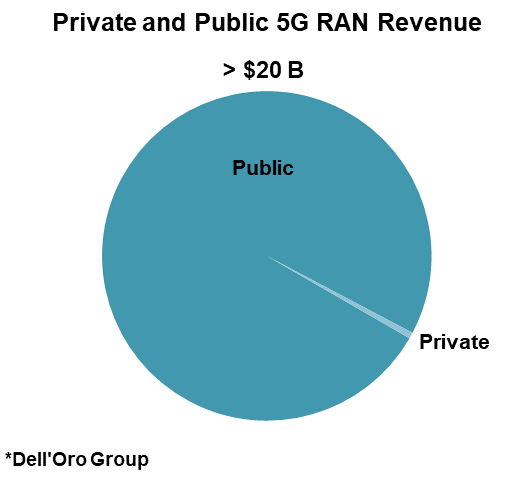

Preliminary 3Q21 estimates suggest the high-level trends remain unchanged with MBB and FWA dominating the 5G capex while private RAN revenues remain small —leading RAN vendors are reporting that private 5G revenues are still negligible relative to the overall public and private 5G RAN market.

Meanwhile, private wireless activity using both macro and local base stations is rising:

- Huawei estimates there are now around 10 K 5G B2B projects globally and the supplier is engaged in thousands of trials focusing on various 5G private use cases.

- Ericsson is currently involved in hundreds of private wireless customer engagements, including pilots with time-critical use cases.

- Even though Nokia’s enterprise business declined year-over-year in 3Q21, Nokia’s private wireless segment continued to gain momentum in the quarter–Nokia now has 380+ private wireless customers.

- ZTE has developed more than 500 cooperative partners in 15 industries, including industrial engineering, transportation, and energy. They have jointly explored 86 innovative 5G application scenarios and successfully carried out more than 60 demonstration projects worldwide supporting multiple 5G IoT use cases.

- Federated Wireless, one of the leading CBRS SAS providers, is working on hundreds of CBRS-based private wireless trials in multiple vertical domains, including warehouse logistics, agriculture, distance learning, and retail applications.

Market Opportunity and Forecast

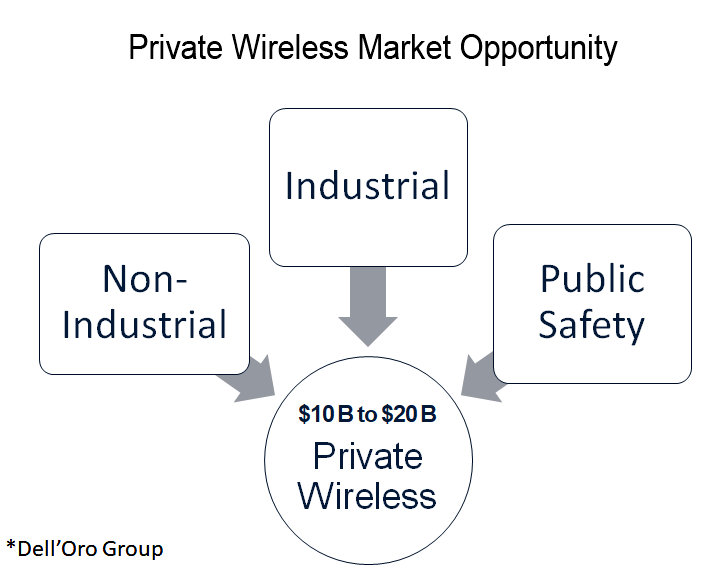

One of the more compelling aspects with private wireless is that we are talking about new revenue streams, incremental to the existing telco capex. More importantly, the TAM is large, approaching $10–20 B when we include Non-Industrial, Industrial, and Public Safety driven applications.

At the same time, it is important to separate the TAM from the forecast. Here at the Dell’Oro Group, we continue to believe that it will take some time for enterprises to fully conceptualize the value of 5G relative to Wi-Fi. And as much as we want 5G to be as easy to deploy and manage as Wi-Fi, the reality is that we are not yet there.

Still, the uptick in the activity adds confidence the industry is moving in the right direction. And although LTE is dominating the private wireless market today, private 5G NR revenues remain on track to surpass $1 B by 2025.

To learn more about Dell’Oro Group Private Wireless advanced market research, please click here for more information.