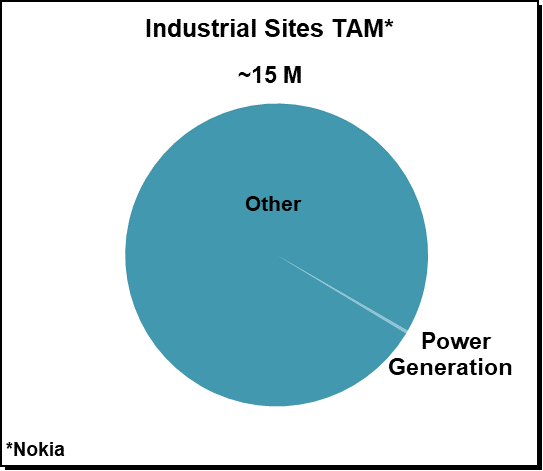

Power generation is perhaps not the shiny object that comes to mind when suppliers and operators think about potential 5G game-changers. After all, Nokia estimates power generation accounts for approximately 0.4 percent of the global industrial site opportunity. At the same time, LTE/5G NR activity for power utility applications using both public and local spectrum are on the rise, reflecting a confluence of factors including the benefits and flexibility with cellular technology, the improved availability of local spectrum, and the renewed sense of urgency to modernize the grid to address more extreme weather variations. In this blog, we will review the cellular power utility opportunity, the benefits of using LTE/5G, typical performance requirements for the electric power industry, and review progress with some of the early cellular electric utility adopters.

The power generation market is small relative to the manufacturing opportunity, however it still sizeable. According to the EIA, there are around 60 K to 65 K power plants globally. China is home to four of the world’s ten largest power plants. In the US, the electric systems consist of around 7 K power plants and 360 K miles of transmission lines (US Department of Energy).

Perhaps more importantly, the push to manage capacity growth while embracing energy efficiency is spurring countries to modernize their power grids with various smart grid capabilities, including improved connectivity solutions.

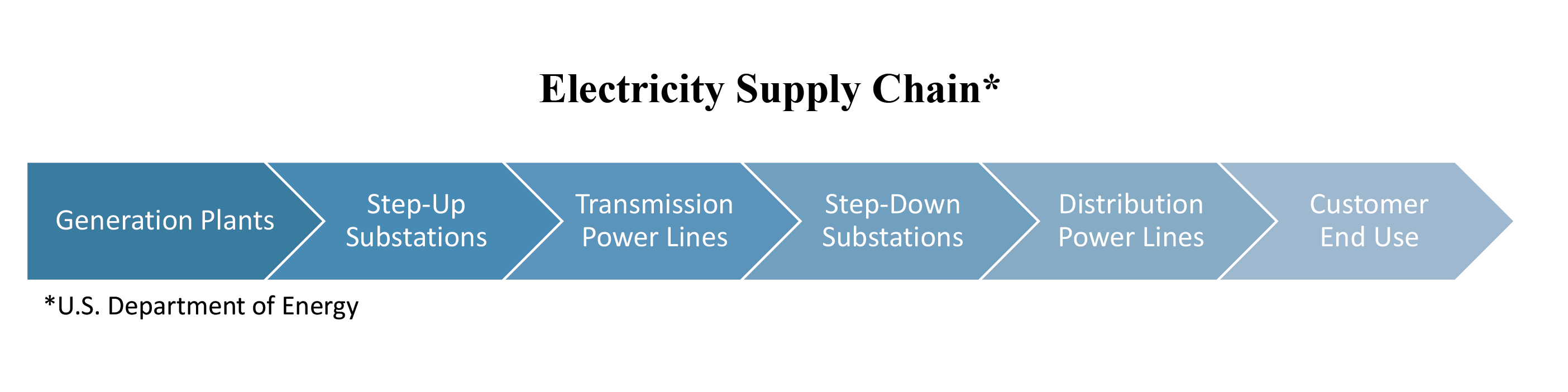

How can cellular technologies help electric utilities? The electricity supply chain can be conceptualized into three high-level functions: generation, transmission, and distribution. One of the more compelling aspects of the power industry is that secure, reliable, flexible high-performance connectivity can make a significant difference in various parts of the electricity supply chain and deliver material savings, both in terms of revenue and lives – there is typically not much effort required to inform this sector about the benefits with LTE and 5G vs. WiFi or other proprietary protocols.

Also, the cost, security, and roadmap benefits with the 3GPP standards are well understood. While the macro mobile network will continue to play an important role with 4G/5G power utility networks, the availability of a new local spectrum will also enable the utilities to improve the coverage in areas with limited macro coverage.

From a service perspective, early 5G adopters are looking into four types of applications including:

- Production control area

- Production non-control area

- Information management

- Local campus coverage

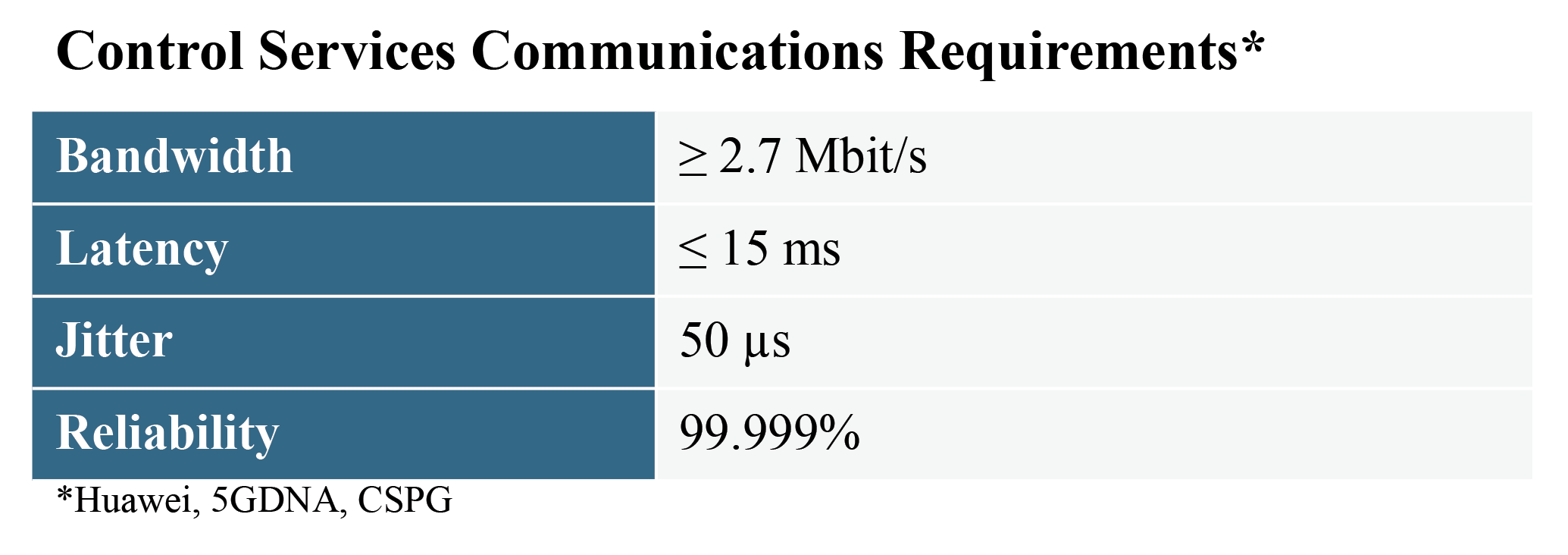

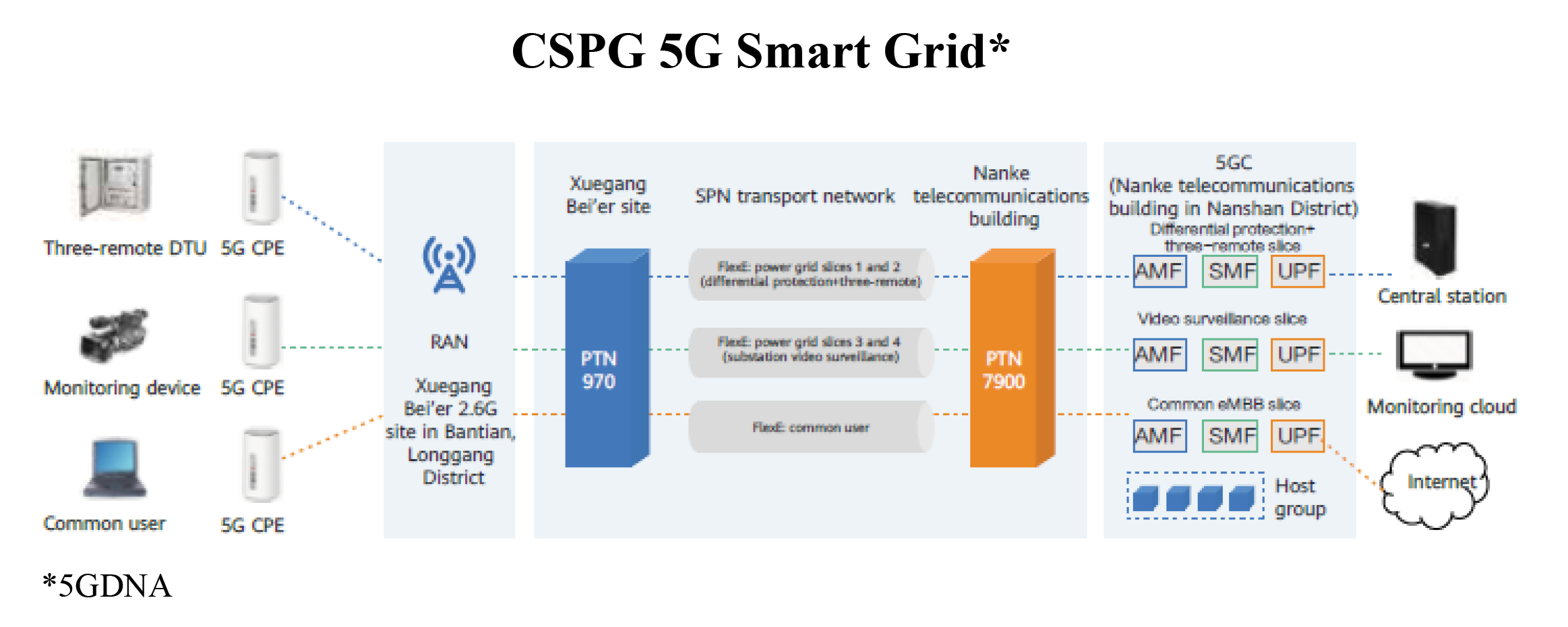

According to the 5G Deterministic Networking Alliance (5GDNA) and China Southern Power Grid (CSPG), 5G slices can help with the production control area to monitor power systems in real-time and address differential protection on power distribution networks, intelligent distributed FA, precise load control, and distributed energy control.

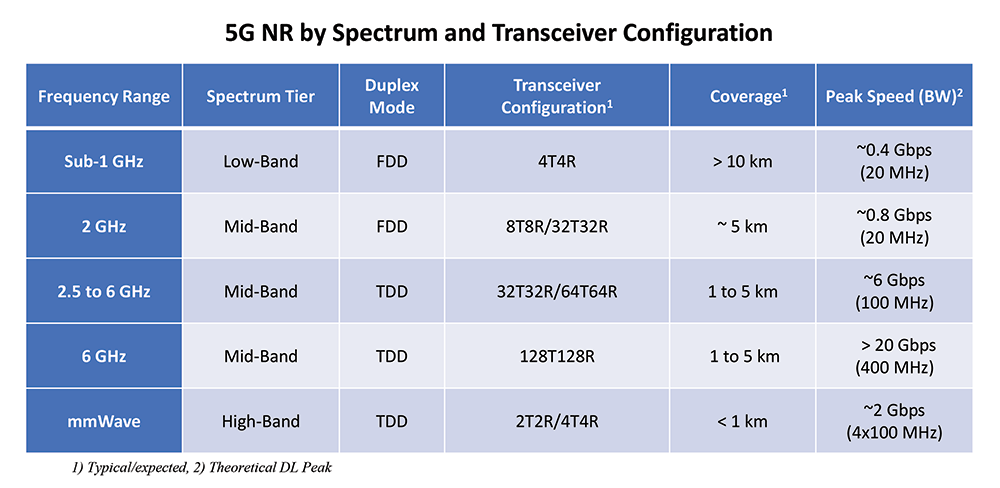

The current use of optical transport for the centralized connection is not always ideal from a capex perspective. Wireless connectivity technologies should be able to deliver an improved cost structure. And according to 5G DNA, 5G is preferred over LTE as the required network latency should be 15 ms or better to provide enough margin to ensure the phase delta does not result in asynchronous monitoring. Also, this type of latency requires the UPFs to be deployed at the edge sites.

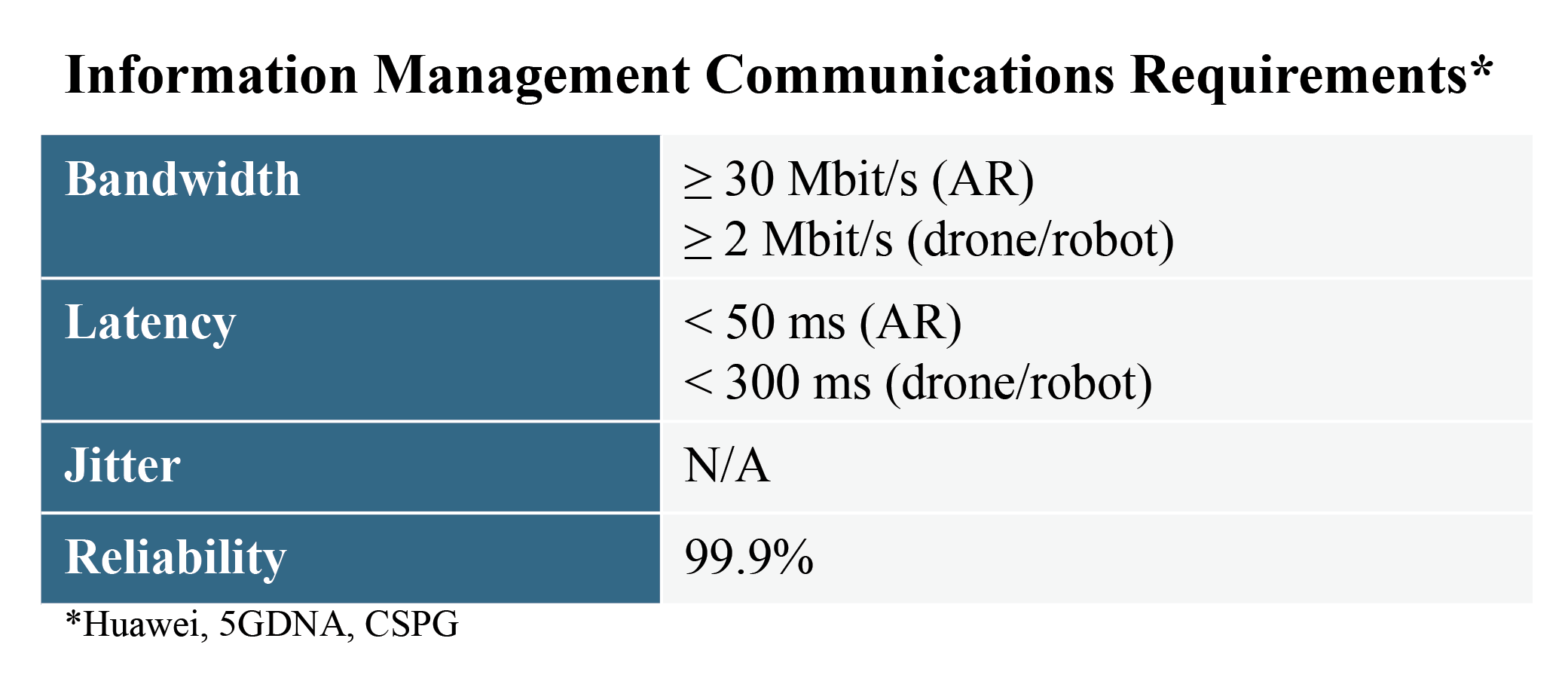

5G is also expected to play an increasingly important role in information management. Utilities still rely heavily on manual inspections, which tend to be inefficient, time-consuming, and in some cases dangerous. LTE and 5G can help to transform these services and provide the right foundation to digitize much of the inspection process including the inspection of substations and transmission lines. Using videos, AR, robots, site cameras – thousands of devices can be checked in real-time.

Historically information management has typically been addressed using 3G/4G, WiFi, and fixed technologies such as optical fiber. But this combination is not always perfect. In addition to the UL limitations, there are also security risks that are better managed with 5G and Multi-Access Edge Computing.

Initial findings with some of the early adopters support the premise that 5G can improve efficiency. CSPG, which covers roughly a quarter billion people in China, has started to incorporate 5G into its connectivity roadmap. Working with China Mobile and Huawei, CSPG is using two separate 5G slices for production control and information management.

Preliminary findings suggest precise fault locating and fast fault isolation for power distribution network differential protections reduces the fault location time from a few second to a few milliseconds.

According to CSPG, 5G enabled them to install new monitoring systems and ultimately reduce the inspection duration for 1330 items from 3 days to 1 hour.

Similarly, the inspection duration for 500 kV power transmission lines has been reduced from 10 days to 2 hours.

In the US, power utilities are exploring how they can leverage the capacity upside with CBRS and the coverage benefits with a low-band spectrum to focus on grid modernization and wildfire prevention. New York Power Authority (NYPA), the largest state public power organization in the US, is exploring how LTE can provide drones with the connectivity needed to manage critical field operations and ultimately reduce the reliance on manual inspections.

In other words, the LTE/5G NR power utility market is nascent. However, the benefits of cellular technologies are clear and the business case is straightforward. And more importantly, we don’t have to wait to verify this narrative – utilities across the world are already exploring and utilizing LTE and 5G NR to modernize various parts of the electricity supply chain. So even if the TAM is somewhat limited relative to other industrial opportunities, the time is right to start getting excited about the incremental value LTE and 5G can deliver to the power utility vertical.