Dell’Oro Group published an update to the Microwave Transmission & Mobile Backhaul market 5-Year Forecast report in July 2021.

xHaul Systems Equipment in Demand

xHaul, a term referring to fronthaul, midhaul, and backhaul as well as transport and packet processing, is projected to grow through the forecast period, reaching nearly $9 billion by 2025. This multi-year growth is expected to be driven by 5G. In the xHaul forecast, we include both Mobile Transport (fronthaul and backhaul) and Routers & Switches. As would be expected, we believe the highest growth in xHaul will be from growing installations of Routers & Switches as more Layer 2 and 3 functions are required in the mobile network.

The Mobile Transport Layer Returns to Growth

The end of the 4G deployment ramp brought a slowdown in both mobile backhaul and fronthaul transport equipment sales. However, this trend seems to be in reverse as 5G rolls out globally. A small glimpse of this reversal, though restrained by the COVID-19 pandemic, was visible in 2020 when the Mobile Transport equipment market increased slightly. We believe the growth in 2020 was just the beginning, and predict that the Mobile Transport market, consisting of mobile backhaul and fronthaul, will grow for many more years and that the cumulative revenue for the next five years will approach $27 billion, a solid increase over the previous five-year period.

Microwave Transmission Important for 5G Backhaul

While much of the growth will be with fiber backhaul systems, we expect wireless backhaul systems such as Microwave Transmission equipment will be a critical component in an operator’s successful rollout of 5G for two simple reasons: fiber is not everywhere and time to market is critical to success.

Therefore, we anticipate that the demand for Microwave Transmission equipment will increase for a number of years and that much of the growth will be from rising sales of E-band radios. We forecast E-Band radio transceiver shipments to grow at a compounded annual growth rate (CAGR) of nearly 30 percent.

About the ReportThe Dell’Oro Group Microwave Transmission & Mobile Backhaul 5-Year Forecast Report offers complete, in-depth coverage with tables covering manufacturers’ revenue, radio transceivers, and average selling prices. The report tracks mobile backhaul by cell type (macro and small cell) and technology (wireless and fiber/copper). The microwave transmission tables forecast point-to-point TDM, Packet and Hybrid Microwave as well as full indoor and full outdoor unit configurations. To purchase this report, please contact us at dgsales@delloro.com |

|

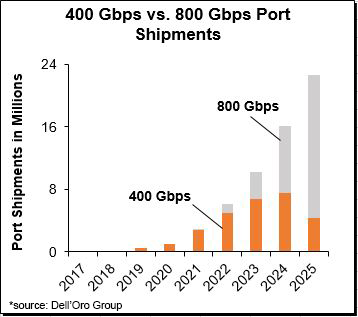

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.

We predict that 800 Gbps adoption will be quick, surpassing 400 Gbps ports in 2024 (Figure). 800 Gbps deployments will be propelled by the availability of 100 Gbps SerDes and will not require 800 GE MAC. As a reminder, our forecast reflects port-switch capacity, regardless of how the port is configured. We expect early 800 Gbps ports to be used in breakout mode either as 8×100 Gbps or as 2×400 Gbps. (Breakout applications support many use cases, such as aggregation, shuffle, better fault tolerance, and bigger Radix.) The anticipated rapid adoption of 800 Gbps will be propelled by: 1) availability of 800 Gbps optics with a significantly lower cost per bit than two discrete 400 Gbps optics; and 2) lower cost per bit at a system level, as 800 Gbps will allow consuming 25.6 Tbps chips in a 1U form factor with 32 ports of 800 Gbps. These systems will have a better cost per bit than their equivalent 400 Gbps (which requires 2 U chassis to fit 64 ports). Since economics drive adoption, we believe that 800 Gbps will be more rapidly adopted than 400 Gbps.