With 5G coverage rapidly expanding around the globe and 5G eMBB driving the lion’s share of the 5G capex, the time is right to start looking beyond the typical MBB connectivity scenario. One of the technologies that is slowly making a bit of a comeback and is expected to play a growing role in the 5G evolution roadmap is positioning. While the concept of using positioning with wide-area cellular or low-power unlicensed technologies to improve location accuracy is far from new and has been around for decades, the combination of the performance and reliability improvements with NR and the growing enthusiasm with vertical opportunities for both IoT and MBB applications that could benefit from precision level accuracy forms the basis for the renewed interest with 5G positioning.

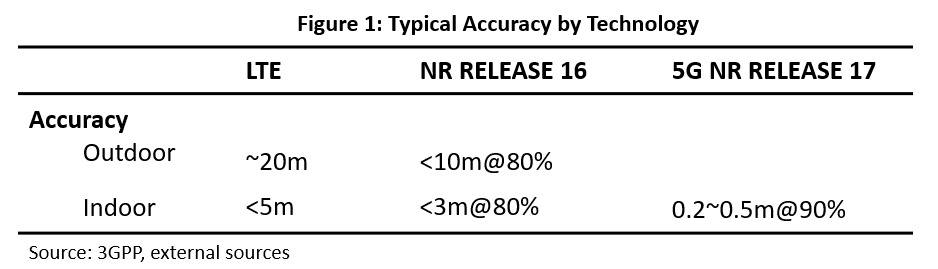

What is so exciting about 5G positioning? The enhancements available with 5G NR Release 16 will deliver significant performance improvements relative to previous cellular technologies and meet the initial baseline requirements of 3 meters and 10 meters for indoor and outdoor horizontal accuracy (80% of the time), respectively. Vertical accuracy is also improved.

And while we don’t know what the world will look like ten years from now, we do know that the requirements for many of the industrial and manufacturing use cases will vary widely in terms of accuracy, reliability and latency. Taking into consideration that the RF carrier bandwidth and the subcarrier spacing impact the overall accuracy, the inherent flexibility with both the 5G NR bandwidth (≤100 MHz vs. ≤ 20 MHz with LTE) and the subcarrier spacing (15 kHz, 30 kHz, 60 kHz, 120 kHz with NR vs 15 kHz with LTE) provides the right foundation and agility to address diverse end user requirements beyond the baseline criteria.

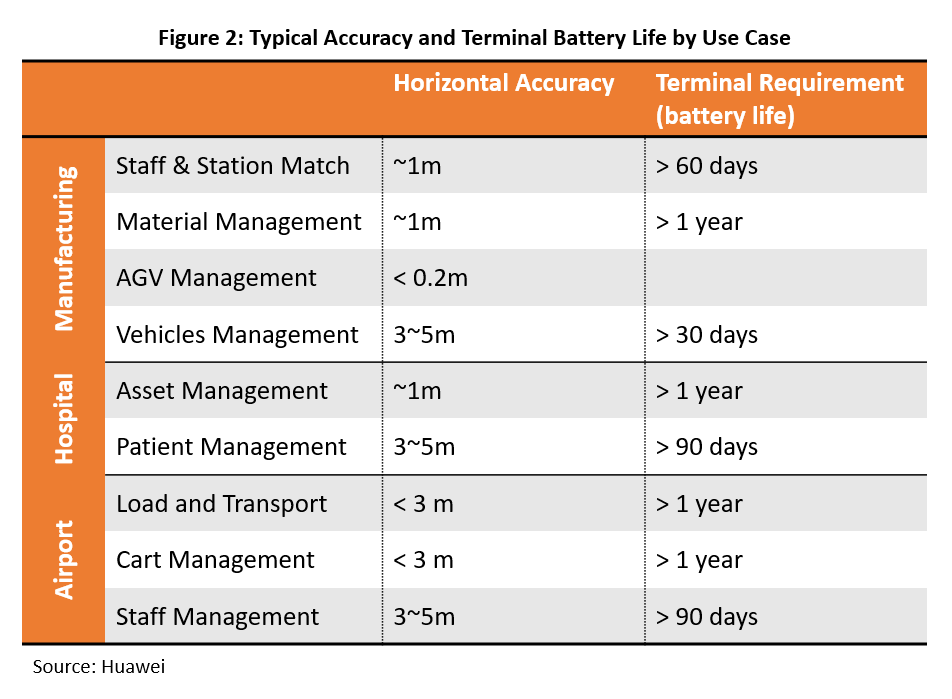

In addition, 5G positioning technologies will address energy improvements to ensure support for a wide range of terminal form factors with differing battery capacity requirements. Per 3GPP service 1, 5G systems with positioning technologies should be able to allow the UE to operate for at least 12 years using less than 1800 mWh of battery capacity, assuming multiple position updates per hour.

Another important component with 5G positioning is the accuracy improvements with moving objects. The value with 5G positioning when combined with GNSS systems could be compelling for vehicle management and V2X applications, to name a few use cases. The 3GPP specification suggests 5G systems shall support a mechanism to determine the UE’s velocity with an accuracy that is better than 0.5 m/s for the speed, with a positioning service availability of 99%.

5G Positioning Roadmap towards LPHAP

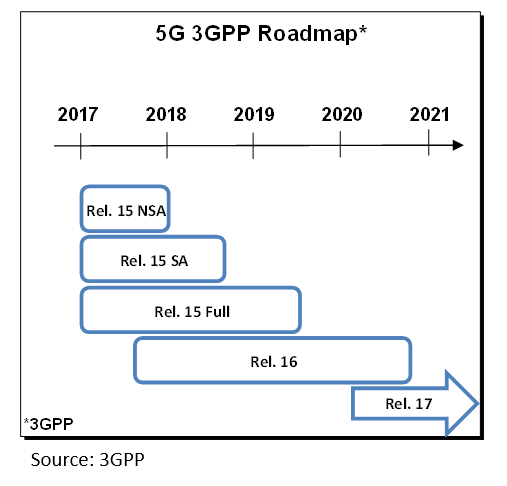

The 3GPP roadmap is continuously evolving to fulfil the overall 5G vision. The schedule for 3GPP Release 15 included three separate steps: early drop focusing on NSA option 3, main drop focusing on SA option 2, and late drop focusing on completion of 4G to 5G migration architectures.

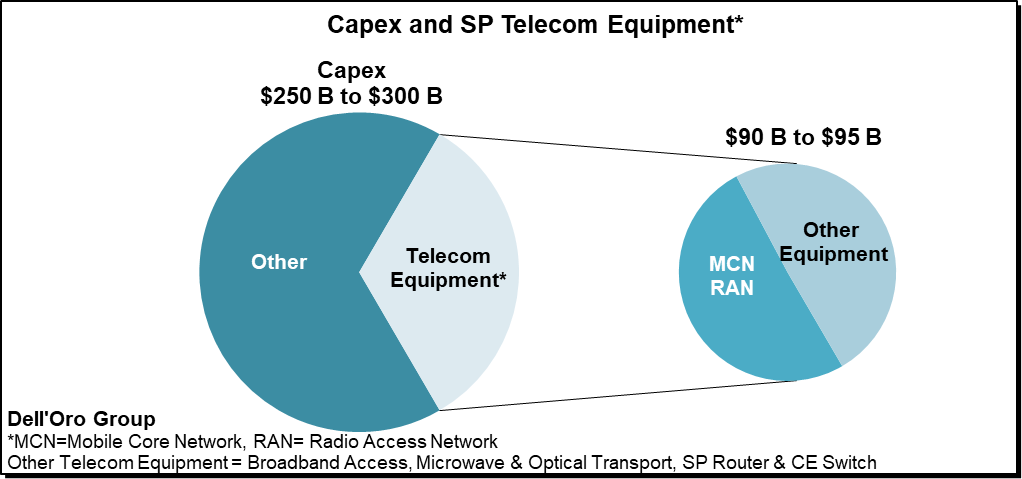

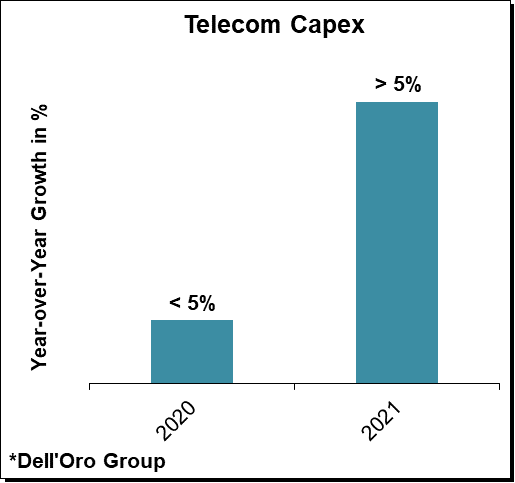

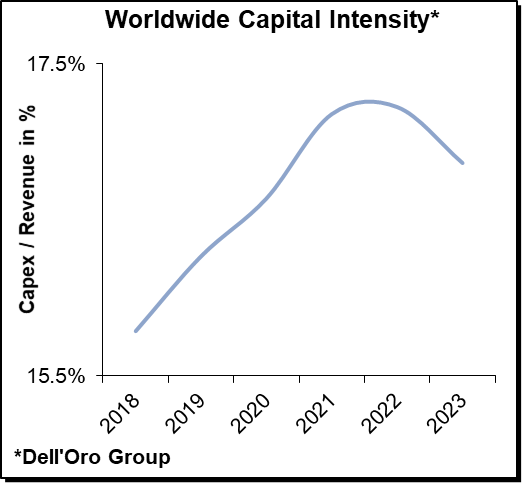

While MBB is dominating the capex mix in this initial 5G phase, the 3GPP roadmap is evolving to address opportunities beyond MBB.

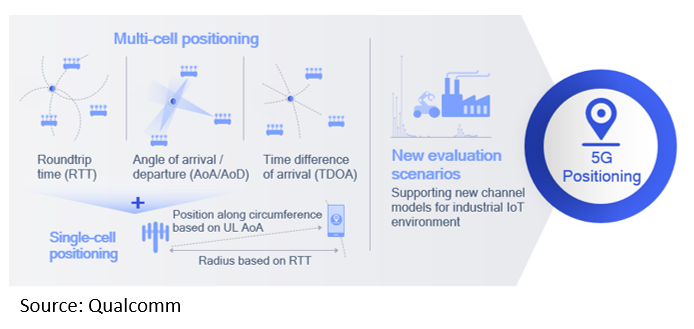

Release 16, also known as 5G Phase 2, was completed in July 2020. The high level vision is that Release 16 will provide the initial foundation to take 5G to the next level beyond the MBB phase, targeting broad-based enhancements for 5G V2X, Industrial IoT / URLLC, and NR-U, including 5G positioning. Though positioning was addressed using LTE overlay with Release 15, Release 16 defines a new dedicated positioning reference signal leveraging various techniques involving both multi-cell and single-cell positioning.

Release 17 is currently slated for early-2022 and will provide more enhancements to realize the full 5G vision, extending operations up to 71 GHz and include enhancements to IoT, Massive MIMO, and DSS, and positioning, with precise indoor positioning providing accuracy in the sub-meter level combined with battery life improvements. LPHAP, known as Low Power High Accuracy Positioning, is the latest work item accepted by 3GPP to specify requirements and standardize low power high accuracy technologies for positioning terminals and services in industrial IoT scenarios.

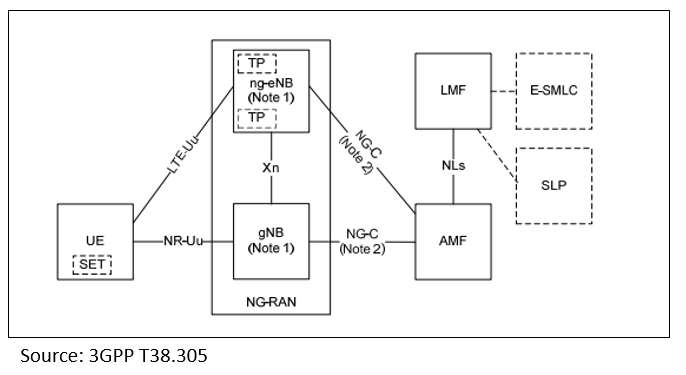

5G Positioning Architecture

In order to improve the performance with 3GPP Release 16, new positioning reference signals (PRS) and a new location management function (LMF) were added to the specification.

5G IoT Market Status

With IoT accounting for about 1% to 2% of total mobile operator revenues, it is still early days in the broader IoT transition. At the same time, IoT revenues are now growing at a faster pace than non-IoT revenues, reflecting improved adoption over the past couple of years since 3GPP started addressing low-power technologies.

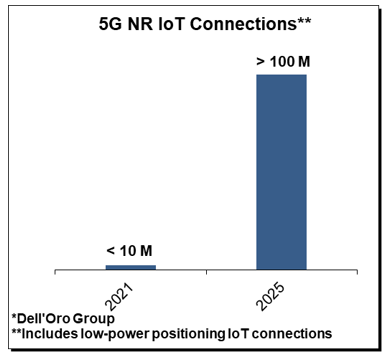

The 5G IoT market is even more nascent but with standards evolving to support new features such as 5G positioning including precise indoor positioning, 5G and private spectrum becoming available, an ecosystem that is accelerating, and signs of activity picking up pace as new use cases are emerging, future prospects remain favorable.

And more importantly, we don’t need to wait for the future to prove this thesis. Preliminary feedback from trials is positive, bolstering the narrative that low power technologies coupled with high accuracy positioning (LPHAP) could play a growing role in the broader 5G IoT market supporting a wide range of applications including hospital asset management, airport equipment scheduling, and manufacturing AGV and material management, to name a few.

In short, the typical eMBB use case is driving the capex today. Vertical activity remains subdued but is on the rise and new enhancements to the 5G roadmap including improved location accuracy with precise indoor functionality and improved energy characteristics could play a role expanding the opportunities with new use cases.