Have you ever seen a caterpillar transform into a butterfly? Within weeks, the entire organism changes to prepare itself for its new mode of existence. This process is called metamorphosis, and it is the best way to describe the change in microwave transmission equipment over time.

For every new generation of communication technology, from long-distance fixed line to mobile, from 3G to 4G, microwave transmission equipment has transformed, filling a need, fulfilling a requirement, changing itself to fit a new mode of existence. This metamorphosis has continued with the emergence of 5G, changing microwave transmission equipment and wireless backhaul for the better.

But why does microwave equipment need to evolve to support 5G backhaul when fiber optics is the future? The answer is easy—operators need the right tool for the job.

Right Tool at the Right Time

Operators, like any other company in a competitive market, will increase its market share and revenue while enjoying higher profits if it is first to market and offers a superior product experience. This drove the rapid deployment of 4G and will drive the rapid deployment of 5G. Therefore, when operators begin to roll out 5G networks, each one will face the same challenge—obtaining full population coverage in the shortest time period to ensure a great customer experience—because, anything less would tarnish the operator’s brand.

To obtain the population and geographic coverage, operators need to deploy 5G in urban areas where people work, suburban areas where they live, and rural areas where customers depend on 5G for connectivity. In all of these areas, the biggest concern will be backhaul. Simply put, without good mobile backhaul, the mobile service will suffer. Luckily, for many operators, they can leverage the existing 4G networks they have built, and in many cases a fiber connection will have been installed over the past few years. Unfortunately, however, in many locations throughout the world, new sites will be needed where operators have yet to install fiber. So, operators need to choose whether to wait one to two years to build a fiber network at costs that can exceed hundreds of thousands of dollars, possibly millions, per site or install a microwave link in under a month at a fraction of the cost. Which is the right tool under this circumstance?

Time and again, microwave systems have proven to be the right tool at the right time. It is one of the many reasons that Microwave Transmission equipment was used in nearly half of all new mobile backhaul deployments for macro cells, globally, in 2019.

Metamorphosis of Microwave

Microwave transmission was used in communication networks as early as 1930 with an experimental connection across the English Channel. During this early stage the application for microwave was for the transport of voice across long distance, across difficult terrains. In time, operators installed microwave systems across continents to deliver tens of thousands of voice circuits to connect cities along one coast to those on the other.

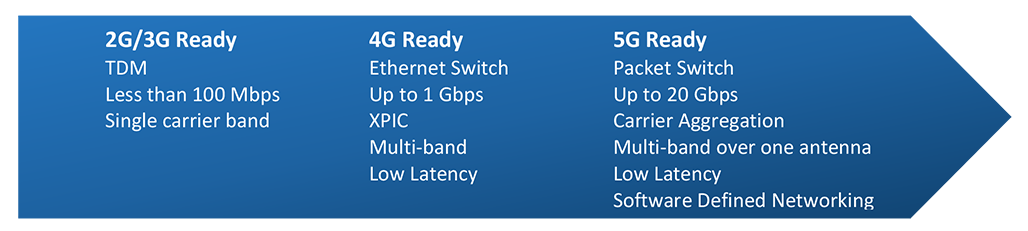

Since those early days, microwave transmission technology evolved, changing to meet the needs of every new generation. When cellular technology emerged, microwave transmission was used to transport hundreds of voice circuits; when 2G arrived, it was used to transmit kilobits of voice traffic; and with 4G, 100s of megabits of data. Over this period, networks shifted away from carrying lots of voice traffic towards transmitting an ever-increasing amount of data, requiring microwave equipment to grow from carrying only analog voice into carrying packets filled with a mixture of high definition voice and massive amounts of data.

When you look at a modern microwave transmission system, it no longer looks like the first system developed to carry a voice call across the English Channel. It has grown and evolved to meet the latest needs of operators, and it has continued to do so for 5G.

The latest Microwave Transmission equipment is more than able to meet the requirements of 5G backhaul with the newest features that include packet switching and up to 20 Gbps of throughput using spectrum in E-band. Other advancements that acclimate microwave to 5G backhaul include carrier aggregation and multi-band links over a single antenna—solutions that both increase the link capacity, improve the performance, and reduce the cost to operate.

And, the story of microwave will not stop here. Leading manufacturers continue to invest in this technology, developing new solutions and features that make microwave transmission more cost effective, simpler to use, and more reliable. Some of these new technologies include developing systems that operate in the D-band to deliver 100 Gbps throughput in a couple years, and others to reduce operational costs by improving the use of leased spectrum. Huawei presented two of these concepts during their 2020 global analyst conference. The first was 4×4 MIMO to quadruple the capacity without adding additional spectrum (deployment at a customer delivered 1 Gbps in 28 MHz), and the other solution that the company called SuperHUB was a novel concept that allows more microwave links at an aggregation site to use the same spectrum.

For the Better?

The answer is “yes.”

✔ Yes, microwave transmission equipment can be used to support 5G backhaul.

✔ Yes, microwave will be used in 5G networks around the world.

✔ Yes, it will save operators valuable time to market.

✔ Yes, it has already been used for 5G backhaul.

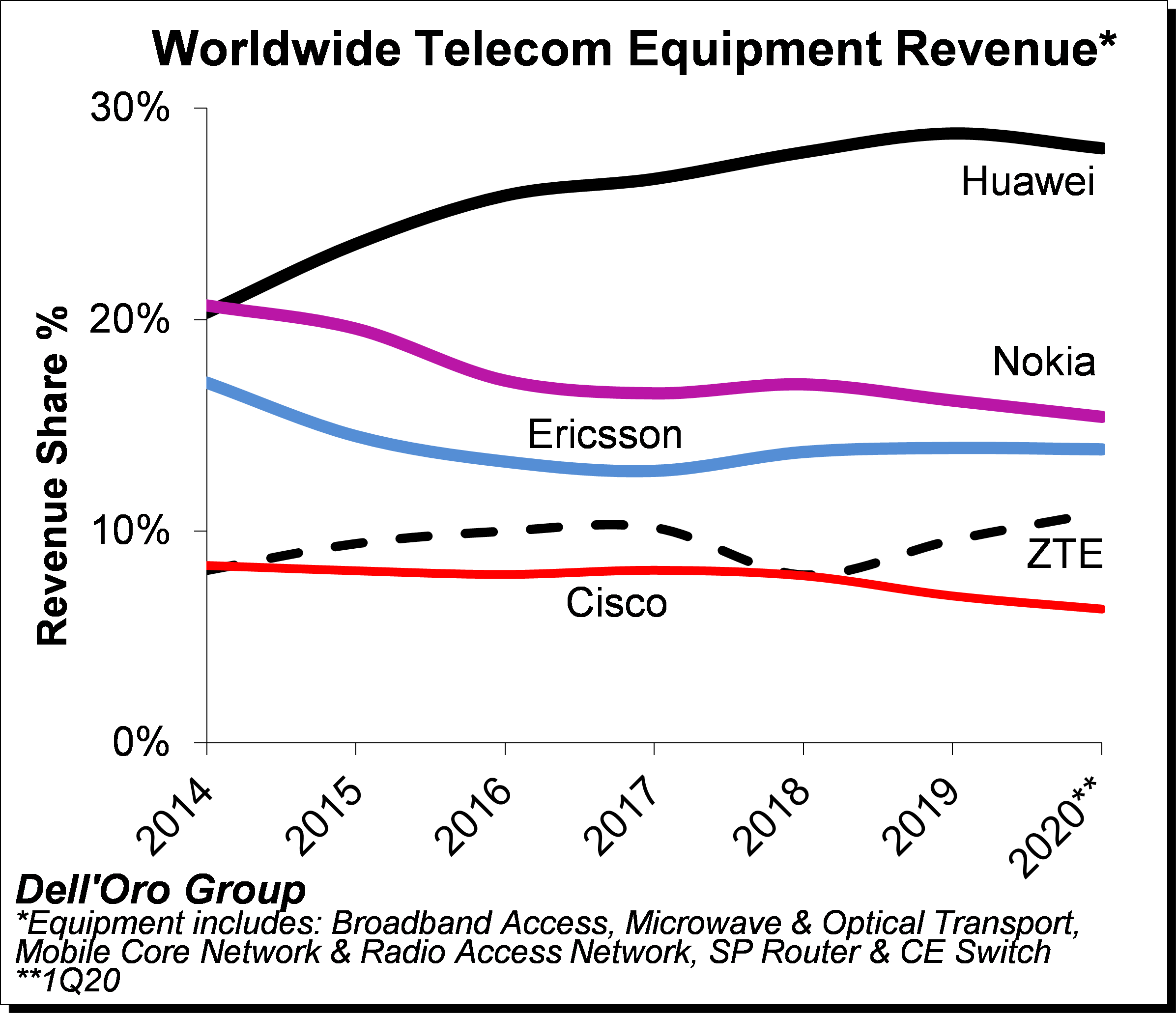

In Dell’Oro Group’s recent Microwave Transmission & Mobile Backhaul 5-year forecast, we studied the demand for 5G and its impact on the microwave transmission market. We concluded that microwave systems will be a significant part of 5G backhaul for many of the reasons mentioned above. As a result, we forecast 5G to drive about $3.5 billion of microwave transmission equipment over the next five years.

Also… Yes, 5G has changed wireless backhaul for the better.