Since 2017, no fewer than ten vendors have launched Smart Network Interface Cards or Smart NICs. The Smart NIC market is projected to become a $600 M market by 2024, or 23% of the total Ethernet adapter market. Vendors have developed or are developing innovative solutions to gain entry in the expanding Cloud data center market, and the emerging telco edge market.

Smart NICs, with an on-board processor, can provide a wide range of offload benefits in the following scenarios:

- For a Public Cloud service provider operating a large-scale data center, Smart NICs could free up valuable CPU cores to run business applications for the end-user, potentially enabling higher server utilization.

- Smart NICs are offered to meet a wide range of offloads. Some of these include transport and storage protocol offloads such as RoCE, TCP, NVMe-over-Fabrics.

- Certain classes of Smart NICs are programmable and can be tailored for a wide range of applications and retooled to meet new requirements.

Smart NICs, however, are not without drawbacks and the following areas would need to be addressed before we see broader adoption:

- Smart NICs are priced at a significant premium over that of a standard NIC. This price premium can be 5-10X higher given the same port speed and need to come down especially for volume production.

- Smart NICs can draw anywhere from 20W up to 80W of power, which is not non-consequential on a per unit server basis.

- Given the programmability and complexity of Smart NICs, they can consume significant engineering resources to develop and debug, resulting in a lengthy and costly implementation.

Given the above considerations the major Cloud service providers and IC vendors have developed Smart NIC adapters based on different IC solutions: ARM-based SoC, field programmable gate arrays (FPGAs), and custom ASICs. Each of these solutions offers varying degrees of offloads and programmability. In general, ARM-based SoCs and FPGAs are fabricated with programmable cores and can be adapted to a wide range of applications. However, the drawback of the programmability is the greater extent of engineering resources and lead time needed to bring the products to market. Custom ASICs tend to be hard-coded with customization generally limited to vendor-provided application tool sets. As products start to ramp and the market reaches consensus on product definition, we expect the following three categories of Ethernet adapters to emerge: 1) traditional or standard NICs, 2) non-programmable Smart NICs that are ASIC-based, and 3) programmable Smart NICs, that are ARM-based or FPGA based.

Network IC vendors that either currently have Smart NIC adapters or are planning to launch one have a wide range of solutions and target market segments. Notable vendors include Broadcom, Ethernity Networks, Intel, Marvell, Mellanox, Napatech, Netronome, Pensando, and Xilinx. The major Cloud service providers have developed their own solutions, further fragmenting market.

Our long-term outlook of the Smart NIC market by market segments is as follows:

- Top 4 U.S. Cloud: In 2019, the Top 4 U.S. Cloud service providers, with Amazon in particular, drove more than 90% of the Smart NIC market by port shipments. This may be a challenging market for Ethernet adapter vendors to enter given that some of these Cloud service providers are likely to continue to develop their own solutions.

- Other Cloud: These segments include Chinese Cloud service providers, such as Alibaba and Tencent, and Tier 2 Cloud service providers such as Apple and Oracle. As these companies scale data center capacity higher, Smart NICs could be a solution to enable higher utilization. These companies may not necessarily have the resources to develop their own Smart NICs, and are likely to seek 3rd party solutions from adapter vendors.

- Telco Operators: This segment is increasingly looking to shift core network services to run on x86 servers, thus, Smart NICs could be used to offload network function virtualization. Certain adapter vendors are also targeting the emerging edge computing market as well, as Smart NICs is complementary to multi-access edge computing (MEC) nodes to satisfy low-latency requirements.

- Enterprise: Generally, enterprise data centers tend to operate at a smaller scale, and would have less incentives to maximize utilization. Many enterprises would also rely on vendors to provide a solution with software implementation in place. Certain workloads, mainly enterprise storage arrays, are being developed with Smart NICs to facilitate NVMe-over-Fabrics connectivity.

As the Smart NIC markets continue to evolve, we believe the success of each vendor depends on whether its solution is a worthwhile upgrade over standard NICs from a performance, price, power consumption, and implementation perspective in their respective target markets. In 2020, activity level is high, as vendors work with end-users to complete product evaluation cycles. We expect to see volume ramp from a greater mix of vendors next year, as some of the short-comings mentioned above are addressed, realizing the benefits of Smart NICs.

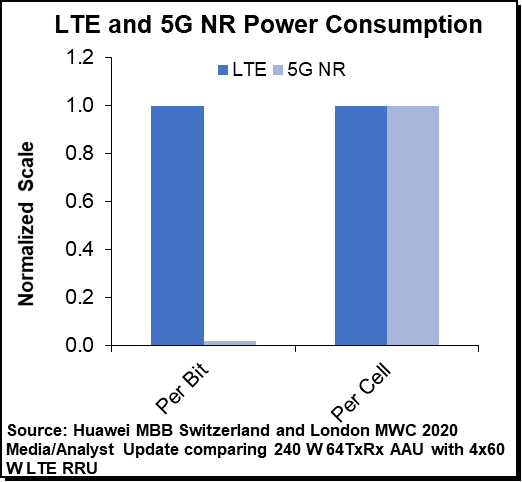

With operators ramping up 5G while still maintaining their legacy 2G-4G networks, the power consumption KPI appears to be moving up the priority list as operators are trying to ensure total 2G-5G cell site power consumption remains within reasonable power budgets.

With operators ramping up 5G while still maintaining their legacy 2G-4G networks, the power consumption KPI appears to be moving up the priority list as operators are trying to ensure total 2G-5G cell site power consumption remains within reasonable power budgets.

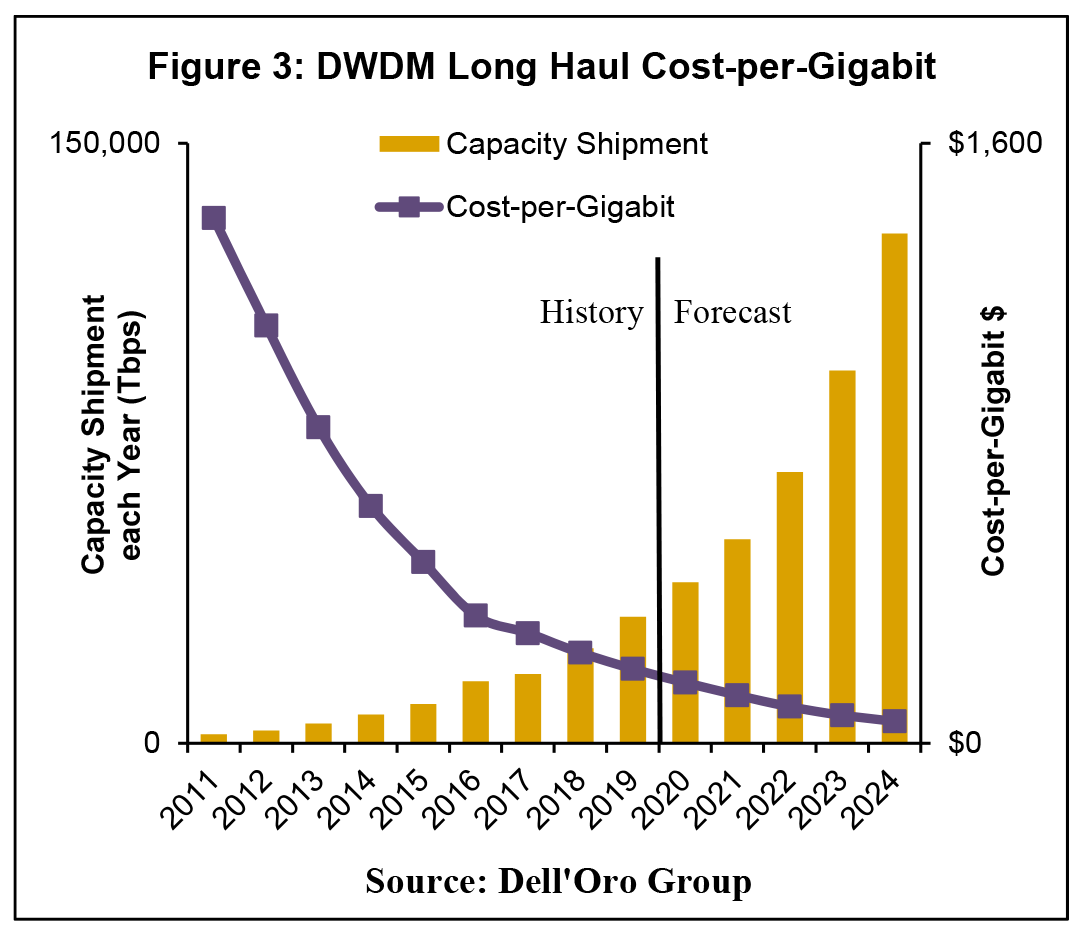

As a point of reference, in the past decade, the average annual decline in cost-per-gigabit for DWDM Long Haul transport equipment was about 20 percent due to improving spectral efficiency gains brought on by deployment of newer, higher-speed wavelengths (Figure 3). It was a similar rate of decline for WDM Metro, as well.

As a point of reference, in the past decade, the average annual decline in cost-per-gigabit for DWDM Long Haul transport equipment was about 20 percent due to improving spectral efficiency gains brought on by deployment of newer, higher-speed wavelengths (Figure 3). It was a similar rate of decline for WDM Metro, as well. Let’s face it, cable equipment vendors are certainly happy to put 2019 behind them. A glut of DOCSIS channel capacity, the lack of significant competitive threats, and indecision around DAA technologies and timing all resulted in a spending slowdown that lopped off 35% of total DOCSIS infrastructure revenue, year-over-year. Traditional, centralized CCAP platforms bore the brunt of the reductions, with total revenue down 41% year-over-year.

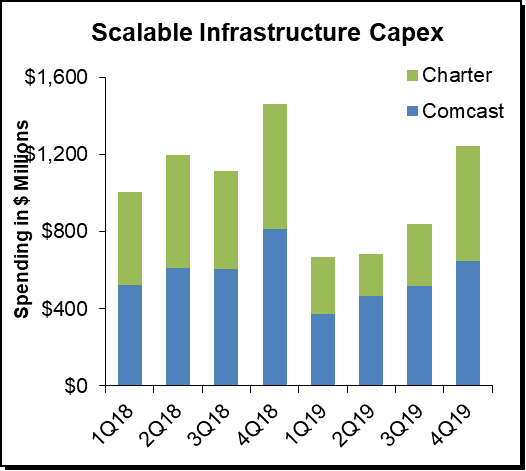

Let’s face it, cable equipment vendors are certainly happy to put 2019 behind them. A glut of DOCSIS channel capacity, the lack of significant competitive threats, and indecision around DAA technologies and timing all resulted in a spending slowdown that lopped off 35% of total DOCSIS infrastructure revenue, year-over-year. Traditional, centralized CCAP platforms bore the brunt of the reductions, with total revenue down 41% year-over-year.