Below are some RAN highlights from the MWC-LA 2018 event. For full access to this blog, please contact Daisy Kwok (Daisy@delloro.com).

FWA and eMBB will dominate the 5G NR capex over the near-term

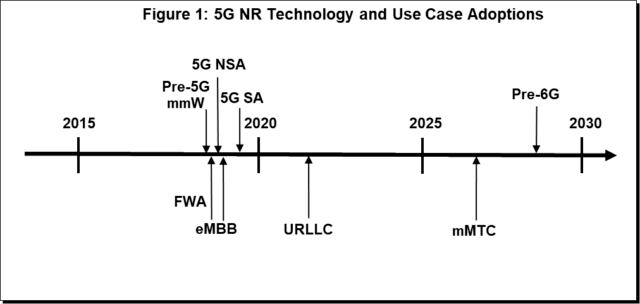

There were no major changes to the timeline we communicated during the July 5-year RAN Forecast — Fixed Wireless Access (FWA) and enhanced mobile broadband (eMBB) are expected to characterize the 5G NR market over the near-term (Figure 1). From a 3GPP standards perspective, low-latency IoT will be addressed in R16 and should be a reality by the 2020 time-frame. But from an adoption perspective, the URLLC use case will likely not be a reality until the 2022 time period.

5G NR eMBB is coming in faster than expected

The overarching takeaway from the show was that the 5G NR eMBB use case is happening at a faster pace than what was originally envisioned. Even with the improved visibility a year ago, the momentum has accelerated. To be clear, the shortened deployment scheduled was already factored into our July 5-year forecast — commercial 5G NR eMBB RAN revenues are still slated for 2H18 and projections are not being revised upward at this juncture. However, feedback from both the supply and demand side during the MWC Americas event added confidence to the forecast we had previously communicated.

The eMBB business case will be driven by cost, capacity, and marketing

The general sentiment at the show was that the 5G NR business case is straight forward from a capacity and cost perspective. From a capacity point of view, there is room left in the tank with LTE utilizing existing resources including carrier aggregation, higher order QAM, Massive MIMO, CBRS, and LAA. The amount of spare capacity will differ from operator to operator depending on the state and utilization of the network and the corresponding spectrum assets.

Nokia presented some rather detailed and interesting models during the MWC event suggesting the average LTE network in the US will run out of capacity by 2022. This is relatively consistent to our own internal findings. Per the July 5-year RAN forecast, we are modeling 5G NR capex in the North America region to be material in 2019 already — 5G NR is expected to account for a significant portion of the 2018-2022 capex in the NA region. In addition to the cost and capacity drivers, the forecast assumes marketing will play an important role accelerating the 5G momentum.

There are multiple aspects to consider from a marketing perspective, including: 1) timing of the first commercial 5G network, 2) timing of nationwide 5G coverage, and 3) advertised data throughputs. As all the Tier 1 operators in the US now have plans to ensure the 5G logo will show up on smartphones nationwide by 2020/2021 using the 600 MHz, 2.5 GHz, Band 5, and Band 66, the focus is increasingly shifting towards the speed component.

mmW and CBRS stimulating enthusiasm for FWA

Consumer mobile is the cash cow but the upside is also limited spurring carriers to balance their investments between the known and unknown opportunities. Not surprisingly, FWA was a hot topic during the MWC event reflecting progress with both the CBRS and mmW spectrum. Factoring in the general industry sentiment towards mmW solutions, Verizon’s 300 Mbit/s announcement for home applications was a positive surprise. Admittedly the advertised speeds were a bit higher than we expected as well. There are still multiple technical and business related hurdles before Verizon can consume a large portion of the fixed home/enterprise market. In addition to propagation challenges as a result of obstacles in the path, technicians are still required to install the home CPE -– a significant cost and time burden.

In addition to providing fiber-like speeds using the mmW spectrum, the CBRS band will play an important role connecting the unconnected and improving the competitive landscape for DSL type services. Federated Wireless recently announced that FWA applications is one of the main drivers of the 16 K CBRS ICDs (Initial Commercial Deployment). And during MWC, AT&T outlined plans to leverage the CBRS spectrum with possible commercial FWA deployments in late 2019.

Competitive landscape will vary depending on the frequency range and country

There is a confluence of variables that could impact the competitive dynamics in the US and globally. There are now more signs that ZTE ban and increased security concerns will impact the 5G NR landscape. Discussions at the show suggest at least one major European operator is looking into phasing out ZTE. Regardless of what the motivations were behind the ZTE ban, one of the implications is that the global 5G NR aspirations for all the vendors need to be aligned with the current geopolitical climate.

Please contact Daisy Kwok (daisy@delloro.com) for full access to this blog.