We just wrapped up the 1Q22 reporting period for all the Telecommunications Infrastructure programs covered at Dell’Oro Group, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch.

External challenges including the war in Ukraine, Covid-19 containment measures, and supply chain disruptions impacted the 1Q22 growth rate but were not enough to derail the positive momentum that has characterized the broader telecom equipment market over the past four years.

Preliminary readings suggest the overall telecom equipment market advanced 4% to 5% year-over-year (Y/Y) in the quarter, underpinned by robust demand for wireline-related equipment and modest growth in wireless.

Regional dynamics were mixed in the quarter. Surging revenue growth in North America (+13%) and modest mid-single-digit expansion in Europe, Middle East & Africa (EMEA) were enough to offset weaker trends in the Asia Pacific region.

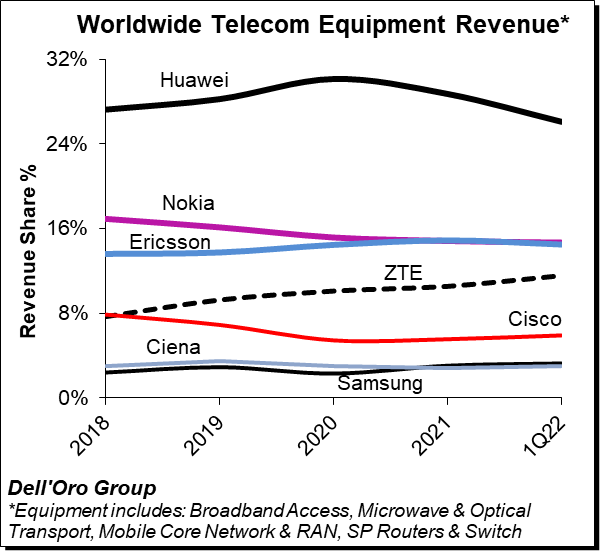

Vendor dynamics were relatively stable in the quarter, with the top 7 suppliers driving around 80% of the overall market. Taking into consideration that the US government started banning Huawei from acquiring US components back in May 2020, Huawei has done a remarkable job supporting its customers and maintaining its leadership position. At the same time, diverging trends between existing and new footprints are putting some downward pressure on Huawei’s revenue share.

Following three consecutive years of steady share advancements, ZTE started the year on a solid footing, primarily driven by share gains in Broadband Access. Our assessment is that ZTE’s 1Q22 telecom equipment revenue share approached 12% in the quarter, up roughly four percentage points since 2018.

Even with the unusual uncertainty surrounding the economy, the supply chains, the war in Ukraine, and China’s zero-Covid-19 policy, the Dell’Oro analyst team remains relatively upbeat about the short-term prospects. Global telecom equipment revenues are projected to increase 4% in 2022 and record a fifth consecutive year of growth. While this is a moderation relative to the 8% growth rate in 2021 and the outlook might initially appear somewhat tepid in real USD terms with inflation hovering around 7%, it is important to keep in mind that the severity of the risks and the visibility vary across the telecom equipment segments.