We just published our latest Carrier Economics Report – covering the second half of 2017 and detailing capital expenditure (capex), revenue, capital intensity, and subscriber trends by region for the top wireless and wireline telecom carriers. With publication of the report, I wanted to share some key takeaways:

- After two consecutive years of declining capex trends, we believe there are reasons to be optimistic about the future. We h

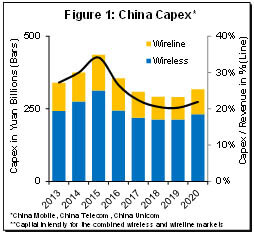

ave adjusted our overall three-year capex expectations upward to reflect a more optimistic investment view than we had originally envisioned in both the US and Chinese markets (Figure 1). Worldwide capex growth is now expected to increase at a compound annual growth rate (CAGR) of one percent in constant currency terms between 2017 and 2020.

ave adjusted our overall three-year capex expectations upward to reflect a more optimistic investment view than we had originally envisioned in both the US and Chinese markets (Figure 1). Worldwide capex growth is now expected to increase at a compound annual growth rate (CAGR) of one percent in constant currency terms between 2017 and 2020. - After three consecutive years of declining capex and improving capital intensity trends in the US telecom market, we maintain the view that conditions are stabilizing and that both capex and capital intensity will continue to trend upward. Aggregate US telecom investments are expected to grow at a high-single digit rate in 2018 and advance at a CAGR of two percent between 2017 and 2020. Multiple factors underpin the renewed optimism for capex in the US, including: (1) Sprint is once again investing, (2) larger data plans are propelling capacity investments, (3) FirstNet investments are set to commence in 2018, (4) corporate tax cuts are boosting AT&T’s 2018 capex, and (5) revenue trends are stabilizing.

- Constrained operator revenue growth is expected to be one of the primary inhibitors of further capex acceleration with 5G. We anticipate that currency adjusted carrier revenues will remain

flat between 2017 and 2020. The forecast assumes that operators will struggle to identify new revenue streams, so as to offset slower smartphone revenue growth.

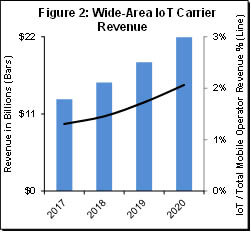

flat between 2017 and 2020. The forecast assumes that operators will struggle to identify new revenue streams, so as to offset slower smartphone revenue growth. - We remain optimistic about the long-term possibilities with IoT. At the same time, we believe the upside will remain limited over the next couple of years. Our baseline estimates assume that carrier IoT revenues will grow ~1.75.x between 2017 and 2020, accounting for about two percent of total mobile operator revenues by 2020. Preliminary IoT connection pricing trends for 2017 are cause for concern, with downside risks to the IoT carrier revenue forecast, should price trends prevail (Figure 2).

For more details, please see https://www.delloro.com/products-and-services/carrier-economics-2